Asked by rosey steel on Mar 10, 2024

Verified

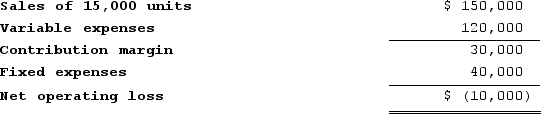

The Draper Corporation is considering dropping its Doombug toy due to continuing losses. Data on the toy for the past year follow:  If the toy were discontinued, Draper could avoid $8,000 per year in fixed costs. The remainder of the fixed costs are not avoidable.The annual financial advantage (disadvantage) for the company from discontinuing the production and sale of Doombugs would be:

If the toy were discontinued, Draper could avoid $8,000 per year in fixed costs. The remainder of the fixed costs are not avoidable.The annual financial advantage (disadvantage) for the company from discontinuing the production and sale of Doombugs would be:

A) ($30,000)

B) $10,000

C) ($22,000)

D) $18,000

Fixed Costs

Expenses that do not change with the level of output or sales over a specific period, such as rent, salaries, or insurance.

Financial Advantage

The gain or benefit obtained in financial terms, often seen in the context of investments or business operations.

- Apprehend the fiscal repercussions of ending the production of a product.

Verified Answer

EG

Emely Gomez

Mar 10, 2024

Final Answer :

C

Explanation :

To calculate the annual financial advantage (disadvantage), we need to compare the total revenue generated by selling Doombugs with the total cost of producing and selling Doombugs, including fixed costs.

Total revenue = 10,000 units x $6 per unit = $60,000

Total variable costs = 10,000 units x $4 per unit = $40,000

Total fixed costs = $30,000

Total cost = $40,000 + $30,000 = $70,000

Profit/loss = Total revenue - Total cost = $60,000 - $70,000 = ($10,000)

If the toy were discontinued, Draper could avoid $8,000 per year in fixed costs. Therefore, the new total fixed costs would be $22,000.

New profit/loss = Total revenue - Total cost = $60,000 - ($40,000 + $22,000) = ($2,000)

The annual financial disadvantage for the company from discontinuing the production and sale of Doombugs would be ($2,000) or -$2,000. This means that discontinuing the toy would result in a loss of $2,000 per year. Therefore, the best choice is C, to not discontinue the Doombug toy, as it would result in a smaller loss than if it were to be discontinued.

Total revenue = 10,000 units x $6 per unit = $60,000

Total variable costs = 10,000 units x $4 per unit = $40,000

Total fixed costs = $30,000

Total cost = $40,000 + $30,000 = $70,000

Profit/loss = Total revenue - Total cost = $60,000 - $70,000 = ($10,000)

If the toy were discontinued, Draper could avoid $8,000 per year in fixed costs. Therefore, the new total fixed costs would be $22,000.

New profit/loss = Total revenue - Total cost = $60,000 - ($40,000 + $22,000) = ($2,000)

The annual financial disadvantage for the company from discontinuing the production and sale of Doombugs would be ($2,000) or -$2,000. This means that discontinuing the toy would result in a loss of $2,000 per year. Therefore, the best choice is C, to not discontinue the Doombug toy, as it would result in a smaller loss than if it were to be discontinued.

Learning Objectives

- Apprehend the fiscal repercussions of ending the production of a product.

Related questions

Assuming All Other Conditions Stay the Same, at What Level ...

The Annual Financial Advantage (Disadvantage)for the Company from Discontinuing the ...

What Would Be the Financial Advantage (Disadvantage)from Dropping Product V86O

Assume That Dropping Product JYMP Would Result in a $90,000 ...

What Would Be the Financial Advantage (Disadvantage)from Dropping Product D74F