Asked by Lucia Callista on Jul 29, 2024

Verified

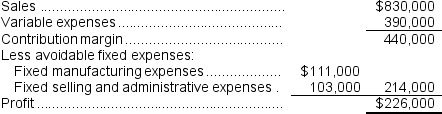

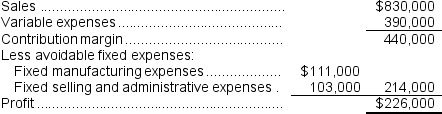

What would be the financial advantage (disadvantage) from dropping product D74F?

A) $226,000

B) $58,000

C) ($226,000)

D) ($58,000)

Financial Advantage

The benefit gained from making a financially prudent decision that leads to wealth accumulation, cost savings, or any other monetary gain.

Dropping Product

The decision to discontinue the production and sale of a product line or item, typically due to it not meeting financial or strategic goals.

- Inspect the financial repercussions of terminating a product's lifecycle.

Verified Answer

SS

Sukhraj SinghJul 31, 2024

Final Answer :

C

Explanation :

The financial advantage of dropping product D74F is the elimination of its negative contribution margin of -$226,000. This means that the product is actually losing money for the company. Therefore, dropping it would save the company $226,000. The financial disadvantage would be the loss of the product's positive contribution margin of $58,000, but since this is outweighed by the negative contribution margin, the overall financial impact would be a positive $226,000.

Explanation :  The company would forego the profit of $226,000 if this product were dropped.

The company would forego the profit of $226,000 if this product were dropped.

Reference: CH11-Ref5

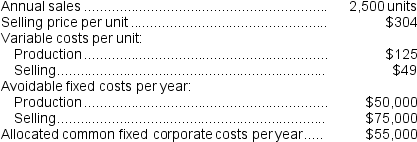

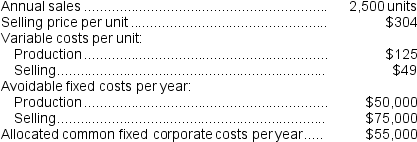

Key Corporation is considering the addition of a new product.The expected cost and revenue data for the new product are as follows: If the new product is added, the combined contribution margin of the other, existing products is expected to drop $65,000 per year.Total common fixed corporate costs would be unaffected by the decision of whether to add the new product.

If the new product is added, the combined contribution margin of the other, existing products is expected to drop $65,000 per year.Total common fixed corporate costs would be unaffected by the decision of whether to add the new product.

The company would forego the profit of $226,000 if this product were dropped.

The company would forego the profit of $226,000 if this product were dropped.Reference: CH11-Ref5

Key Corporation is considering the addition of a new product.The expected cost and revenue data for the new product are as follows:

If the new product is added, the combined contribution margin of the other, existing products is expected to drop $65,000 per year.Total common fixed corporate costs would be unaffected by the decision of whether to add the new product.

If the new product is added, the combined contribution margin of the other, existing products is expected to drop $65,000 per year.Total common fixed corporate costs would be unaffected by the decision of whether to add the new product.

Learning Objectives

- Inspect the financial repercussions of terminating a product's lifecycle.

Related questions

What Would Be the Financial Advantage (Disadvantage)from Dropping Product V86O

Assume That Dropping Product JYMP Would Result in a $90,000 ...

Assume That Dropping Product JYMP Will Have No Effect on ...

Assuming All Other Conditions Stay the Same, at What Level ...

According to the Company's Accounting System, What Is the Net ...