Asked by Mariah Donnally on Jul 30, 2024

Verified

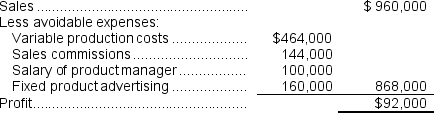

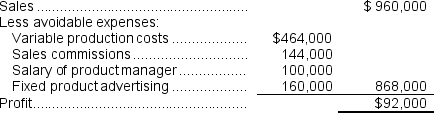

Assume that dropping Product JYMP would result in a $90,000 increase in the contribution margin of other products.If Balser chooses to discontinue JYMP, the annual financial advantage (disadvantage) of eliminating this product should be:

A) ($40,000)

B) $40,000

C) ($2,000)

D) $50,000

Contribution Margin

The amount remaining from sales revenues after all variable expenses are paid, contributing towards covering fixed costs and profit.

Discontinue

To stop making or providing a product or service, often as a strategic decision by a company.

- Review the economic effects of discontinuing a product from the market.

Verified Answer

AD

Akhil DatlaJul 31, 2024

Final Answer :

C

Explanation :  The company would lose $960,000 in sales while saving only $868,000 in expenses-a net effect of a decrease of $92,000.This would be offset by the $90,000 increase in contribution margin of other products, so the net effect would be a $2,000 financial disadvantage.

The company would lose $960,000 in sales while saving only $868,000 in expenses-a net effect of a decrease of $92,000.This would be offset by the $90,000 increase in contribution margin of other products, so the net effect would be a $2,000 financial disadvantage.

Reference: CH11-Ref9

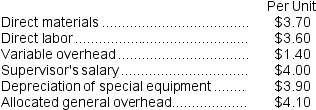

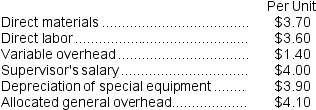

Mcfarlain Corporation is presently making part U98 that is used in one of its products.A total of 7,000 units of this part are produced and used every year.The company's Accounting Department reports the following costs of producing the part at this level of activity: An outside supplier has offered to produce and sell the part to the company for $17.10 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

An outside supplier has offered to produce and sell the part to the company for $17.10 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

The company would lose $960,000 in sales while saving only $868,000 in expenses-a net effect of a decrease of $92,000.This would be offset by the $90,000 increase in contribution margin of other products, so the net effect would be a $2,000 financial disadvantage.

The company would lose $960,000 in sales while saving only $868,000 in expenses-a net effect of a decrease of $92,000.This would be offset by the $90,000 increase in contribution margin of other products, so the net effect would be a $2,000 financial disadvantage.Reference: CH11-Ref9

Mcfarlain Corporation is presently making part U98 that is used in one of its products.A total of 7,000 units of this part are produced and used every year.The company's Accounting Department reports the following costs of producing the part at this level of activity:

An outside supplier has offered to produce and sell the part to the company for $17.10 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

An outside supplier has offered to produce and sell the part to the company for $17.10 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

Learning Objectives

- Review the economic effects of discontinuing a product from the market.

Related questions

What Would Be the Financial Advantage (Disadvantage)from Dropping Product V86O

What Would Be the Financial Advantage (Disadvantage)from Dropping Product D74F

Assume That Dropping Product JYMP Will Have No Effect on ...

Assuming All Other Conditions Stay the Same, at What Level ...

According to the Company's Accounting System, What Is the Net ...