Asked by Lucia Cantu on Jun 11, 2024

Verified

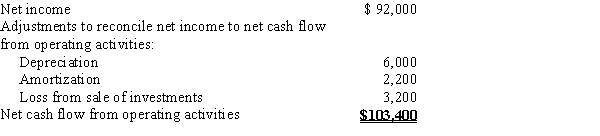

Samuel Company's accumulated depreciation-equipment account increased by $6,000, while patents decreased by $2,200 between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a loss of $3,200 from the sale of investments. Assume no changes in noncash current assets and liabilities.Samuel Company reported a net income of $92,000. Determine net cash flow from operating activities using the indirect method.

Statement of Cash Flows

It's a financial document summarizing the total cash entering a company from operational earnings and investment revenues, as well as the cash spent on business-related activities and investment outlays during a specific period.

Operating Activities

Business activities related to the day-to-day operations that generate revenue, such as sales and purchasing of inventory.

Indirect Method

In accounting, a method used to calculate cash flows from operating activities by starting with net income and adjusting for non-cash transactions.

- Alter net profits in response to changes in assets and liabilities involved in operations to calculate cash flows from these activities.

- Revise the declared net income to reflect adjustments for non-cash transactions and the financial impact of asset sales.

Verified Answer

Learning Objectives

- Alter net profits in response to changes in assets and liabilities involved in operations to calculate cash flows from these activities.

- Revise the declared net income to reflect adjustments for non-cash transactions and the financial impact of asset sales.

Related questions

On the Basis of the Following Data for Breach Co ...

On the Basis of the Following Data for Branch Co ...

The Comparative Balance Sheets of Barry Company, for Years 1 ...

The Comparative Balance Sheets of Posner Company, for Years 1 ...

Samuel Company's Accumulated Depreciation-Equipment Increased by $6,000, While Patents Decreased ...