Asked by Güney Güne? on Jun 30, 2024

Verified

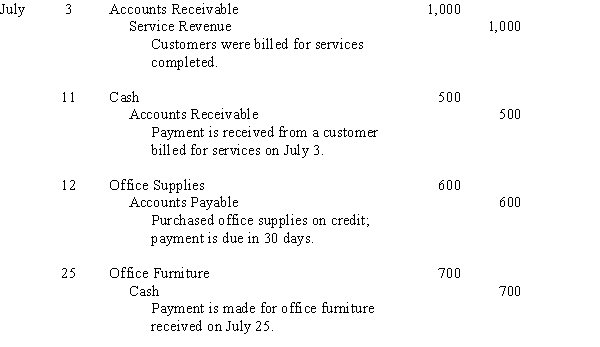

The bookkeeper for Brockton Industries prepared the following journal entries and posted the entries to the general ledger as indicated in the T accounts presented. Assume that the dollar amounts and the descriptions of the entries are correct.

RequiredIf you assume that all journal entries have been recorded correctly, use the above information to:

RequiredIf you assume that all journal entries have been recorded correctly, use the above information to:

(1) Identify the postings to the general ledger that were made incorrectly.

(2) Describe how the each incorrect posting should have been made.

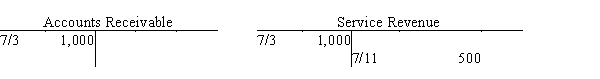

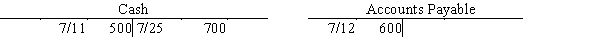

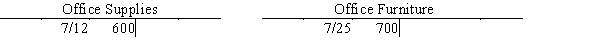

T Accounts

A graphic representation of a journal entry in accounting, shaped like a "T", showing debits on the left and credits on the right.

- Recognize and rectify prevalent mistakes in journal entries and trial balances.

Verified Answer

TH

Taylor HenryJul 06, 2024

Final Answer :

(1) The bookkeeper incorrectly posted the July 3, July 11, and 12 journal entries.

(2) For the July 3 journal entry, the $1,000 credit to Service Revenue should have been posted to the Service Revenue account as a credit, not as a debit. For the July 11 journal entry, the $500 credit should be posted to Accounts Receivable, not to Service Revenue. For the July 12 journal entry, the $600 credit to Accounts Payable should have been posted as a credit, not as a debit.

(2) For the July 3 journal entry, the $1,000 credit to Service Revenue should have been posted to the Service Revenue account as a credit, not as a debit. For the July 11 journal entry, the $500 credit should be posted to Accounts Receivable, not to Service Revenue. For the July 12 journal entry, the $600 credit to Accounts Payable should have been posted as a credit, not as a debit.

Learning Objectives

- Recognize and rectify prevalent mistakes in journal entries and trial balances.