Asked by Emanuel Holesome on May 07, 2024

Verified

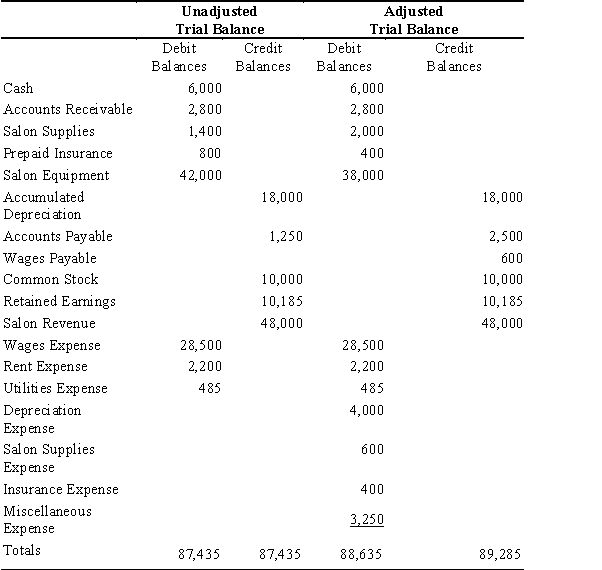

The unadjusted and adjusted trial balances for Ellen's Coiffures is shown below. Assume that all balances in the unadjusted trial balance column and the amounts of the adjustments are correct. Further assume that $400 of insurance expired during the year. Locate the errors in the accountant's adjusting entries, assuming that none of the accounts was affected by more than one adjusting entry.

Adjusted Trial Balances

An internal document that lists all accounts and their balances after adjustments are made for errors, accruals, and deferrals, used for preparing financial statements.

Adjusting Entries

Financial records made upon the completion of an accounting cycle to allocate gains and deductions to the actual period in which they occurred.

Insurance Expired

Indicates the end of an insurance policy's coverage period.

- Elucidate the objectives and processes behind adjusted trial balances.

- Assess the impact of inaccuracies in journal entries on the adjusted trial balance.

Verified Answer

Learning Objectives

- Elucidate the objectives and processes behind adjusted trial balances.

- Assess the impact of inaccuracies in journal entries on the adjusted trial balance.

Related questions

The Adjusted Trial Balance Verifies That Total Debits Equals Total ...

Adjusting Journal Entries Are Dated on the Last Day of ...

Which of the Following Best Describes the Difference Between an ...

When Is the Adjusted Trial Balance Prepared ...

The Unadjusted Trial Balance Columns of a Work Sheet Total ...