Asked by Jessica Pierre on Jun 30, 2024

Verified

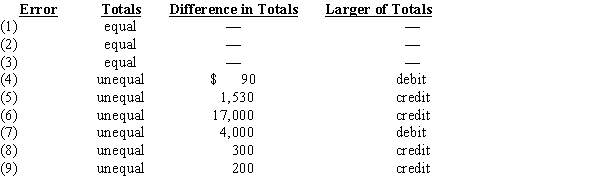

Answer the following questions for each of the errors listed below, considered individually:

(a)Did the error cause the trial balance totals to be unequal?

(b)What is the amount of the difference between the trial balance totals

(where applicable)?

(c)Which of the trial balance totals, debit or credit, is the larger

(where applicable)?Present your answers in columnar form, using the following headings:Errors:  (1)A withdrawal of $3,000 cash by the owner was recorded by a debit of $3,000 to Salary Expense and a credit of $3,000 to Cash.

(1)A withdrawal of $3,000 cash by the owner was recorded by a debit of $3,000 to Salary Expense and a credit of $3,000 to Cash.

(2)A $650 purchase of supplies on account was recorded as a debit of $1,650 to Equipment and a credit of $1,650 to Accounts Payable.

(3)A purchase of equipment for $3,450 on account was not recorded.

(4)An $870 receipt on account was recorded as an $870 debit to Cash and a $780 credit to Accounts Receivable.

(5)A payment of $1,530 cash on account was recorded only as a credit to Cash.

(6)Cash sales of $8,500 were recorded as a credit of $8,500 to Cash and a credit of $8,500 to Fees Earned.

(7)The debit to record a $4,000 cash receipt on account was posted twice; the credit was posted once.

(8)The credit to record a $300 cash payment on account was posted twice; the debit was posted once.

(9)The debit balance of $7,400 in Accounts Receivable was recorded in the trial balance as a debit of $7,200.

Trial Balance Totals

The aggregate sum of all debit and credit balances in a trial balance, which should equal each other, verifying the mathematical accuracy of the ledger accounts.

Cash Withdrawal

The act of taking money out of a bank account, which decreases the account balance.

- Identify and correct common errors in journal entries and trial balances.

Verified Answer

ZK

Learning Objectives

- Identify and correct common errors in journal entries and trial balances.

Related questions

Below Is the Unadjusted Trial Balance for Dawson Designs Co ...

The Bookkeeper for Brockton Industries Prepared the Following Journal Entries ...

The Unadjusted and Adjusted Trial Balances for Ellen's Coiffures Is ...

Balance Entered on Wrong Side of Account ...

Trial Balance Column Incorrectly Added ...