Asked by Keshawn Johnson on May 14, 2024

Verified

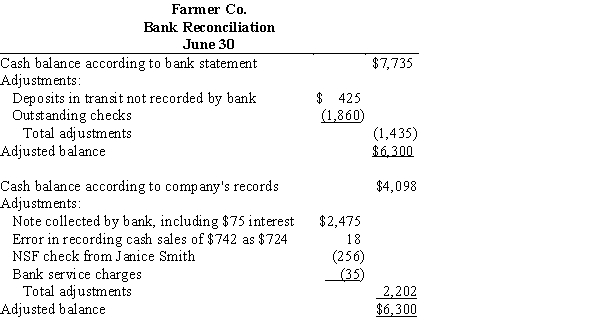

The bank statement for Farmer Co. indicates a balance of $7,735.00 on June 30. After the journal entries for June had been posted, the cash account had a balance of $4,098.00. Prepare a bank reconciliation on the basis of the following reconciling items:

(a)Cash sales of $742 had been erroneously recorded in the cash receipts journal as $724.(b)Deposits in transit not recorded by bank, $425.(c)Bank debit memo for service charges, $35.(d)Bank credit memo for note collected by bank, $2,475 including $75 interest.(e)Bank debit memo for $256 NSF (not sufficient funds) check from Janice Smith, a customer.(f)Checks outstanding, $1,860.

Bank Reconciliation

The process of comparing and adjusting the balance shown in an organization's bank statement, with the balance shown in its own financial records.

Deposits In Transit

Funds that have been deposited in a bank account but not yet recorded by the bank in the account balance, often due to timing differences.

NSF Check

A check that cannot be processed due to insufficient funds in the account it's drawn against, leading to a "non-sufficient funds" status.

- Undertake bank reconciliations to change the cash account balance.

Verified Answer

Learning Objectives

- Undertake bank reconciliations to change the cash account balance.

Related questions

The Following Data Were Gathered to Use in Reconciling the ...

When Bank Errors Are Detected by a Company on the ...

The Cash Balance Per Books for Potter Company on September ...

The Following Information Was Used to Prepare the March 2016 ...

The Information Below Relates to the Cash Account in the ...