Asked by Andres Velazquez on May 05, 2024

Verified

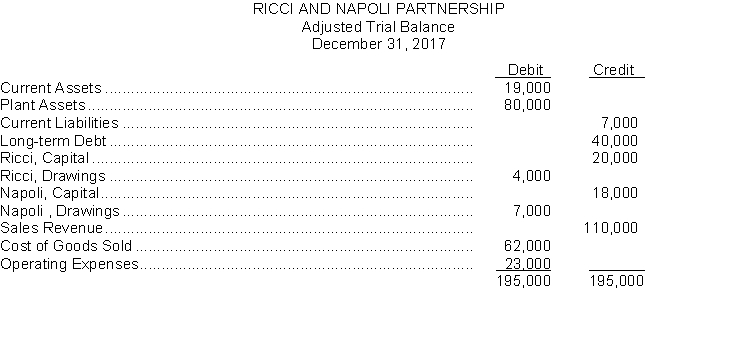

The adjusted trial balance of the Ricci and Napoli Partnership for the year ended December 31 2017 appears below:  The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows:

The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows:

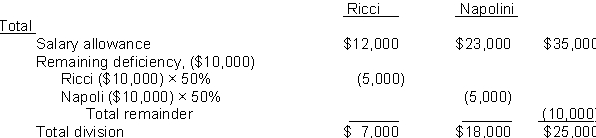

1. A salary allowance of $12000 to Ricci and $23000 to Napoli.

2. The remainder is to be divided equally.

Instructions

(a) Prepare a schedule which shows the division of net income to each partner.

(b) Prepare the closing entries for the division of net income and for the drawings accounts at December 31 2017.

Salary Allowance

A fixed amount of money paid regularly to employees in addition to their normal salary for specific purposes.

Net Income

The total profit of a company after accounting for all costs and expenses, including taxes and interest.

Division

A large section or branch of a company that operates somewhat independently while remaining part of the larger entity.

- Determine the distribution of net earnings among partners in accordance with distinct arrangements.

- Develop a statement reflecting a partner's capital account and chronicle partnership activities.

Verified Answer

JD

joseph donaldMay 11, 2024

Final Answer :

(a) Schedule for Division of Net Income Sales Revenue $110,000Cost of goods sold 62,000‾Gross profit 48,000Operating expenses 23,000‾ Net income $25,000\begin{array}{llr} \text { Schedule for Division of Net Income } &\\ \text {Sales Revenue } &\$110,000\\ \text {Cost of goods sold } &\underline{62,000}\\ \text {Gross profit } &48,000\\ \text {Operating expenses } &\underline{23,000}\\ \text { Net income } &\$25,000\\\end{array} Schedule for Division of Net Income Sales Revenue Cost of goods sold Gross profit Operating expenses Net income $110,00062,00048,00023,000$25,000

(b)

Dec. 31 Income Summary 25,000 Ricci, Capital 7,000Napoli, Capital 18,000 (To close net income to capital) 31 Ricci, Capital4,000 Napoli, Capital 7,000 Ricci, Drawings 4,000 Napoli, Drawings.7,000 (To close drawing accounts to capital) \begin{array}{llr} \text {Dec. 31 } &\text { Income Summary } &25,000\\& \text { Ricci, Capital } &&7,000\\& \text {Napoli, Capital } &&18,000\\ &\text { (To close net income to capital) } &\\\\31 & \text { Ricci, Capital} &4,000\\ &\text { Napoli, Capital } &7,000\\ &\text { Ricci, Drawings } &&4,000\\& \text { Napoli, Drawings.} &&7,000\\& \text { (To close drawing accounts to capital) } &\\\end{array}Dec. 31 31 Income Summary Ricci, Capital Napoli, Capital (To close net income to capital) Ricci, Capital Napoli, Capital Ricci, Drawings Napoli, Drawings. (To close drawing accounts to capital) 25,0004,0007,0007,00018,0004,0007,000

(b)

Dec. 31 Income Summary 25,000 Ricci, Capital 7,000Napoli, Capital 18,000 (To close net income to capital) 31 Ricci, Capital4,000 Napoli, Capital 7,000 Ricci, Drawings 4,000 Napoli, Drawings.7,000 (To close drawing accounts to capital) \begin{array}{llr} \text {Dec. 31 } &\text { Income Summary } &25,000\\& \text { Ricci, Capital } &&7,000\\& \text {Napoli, Capital } &&18,000\\ &\text { (To close net income to capital) } &\\\\31 & \text { Ricci, Capital} &4,000\\ &\text { Napoli, Capital } &7,000\\ &\text { Ricci, Drawings } &&4,000\\& \text { Napoli, Drawings.} &&7,000\\& \text { (To close drawing accounts to capital) } &\\\end{array}Dec. 31 31 Income Summary Ricci, Capital Napoli, Capital (To close net income to capital) Ricci, Capital Napoli, Capital Ricci, Drawings Napoli, Drawings. (To close drawing accounts to capital) 25,0004,0007,0007,00018,0004,0007,000

Learning Objectives

- Determine the distribution of net earnings among partners in accordance with distinct arrangements.

- Develop a statement reflecting a partner's capital account and chronicle partnership activities.