Asked by Ashley Ochoa on May 11, 2024

Verified

Ando Dadd and Porter formed a partnership on January 1 2017. Ando invested $60000 Dadd $60000 and Porter $140000. Ando will manage the store and work 40 hours per week in the store. Dadd will work 20 hours per week in the store and Porter will not work. Each partner withdrew 40 percent of his income distribution during 2017. If there was no income distribution to a partner there were no withdrawals of cash.

Instructions

Compute the partners' capital balances at the end of 2017 under the following independent conditions: (Hint: Use T accounts to determine each partner's capital balances.)

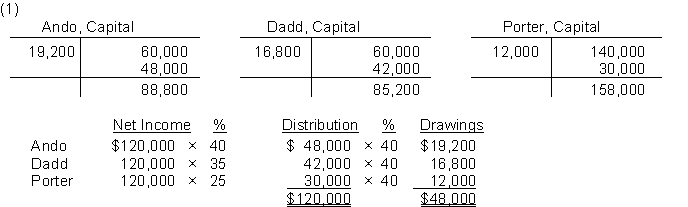

(1) Net income is $120000 and the income ratio is Ando 40% Dadd 35% and Porter 25%.

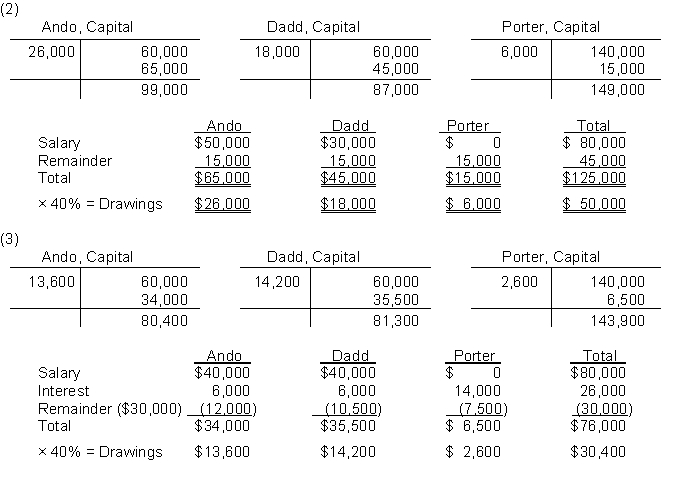

(2) Net income is $125000 and the partnership agreement only specifies a salary of $50000 to Ando and $30000 to Dadd.

(3) Net income is $76000 and the partnership agreement provides for (a) a salary of $40000 to Ando and $40000 to Dadd (b) interest on beginning capital balances at the rate of 10% and (c) any remaining income or loss is to be shared by Ando 40% Dadd 35% and Porter 25%.

Capital Balances

Capital balances represent the amount of capital a business or individual has invested or retained in a company, often reflecting ownership equity.

Net Income

The total earnings of a company after subtracting all expenses, taxes, and costs from total revenue.

Income Distribution

The allocation of earned income or revenue to various stakeholders, such as dividends to shareholders or wages to employees.

- Compose a capital statement for a partner and enter partnership dealings in the journal.

- Calculate the allocation of net profits among partners based on differing agreements.

Verified Answer

MI

Learning Objectives

- Compose a capital statement for a partner and enter partnership dealings in the journal.

- Calculate the allocation of net profits among partners based on differing agreements.