Asked by marta kebede on Jun 24, 2024

Verified

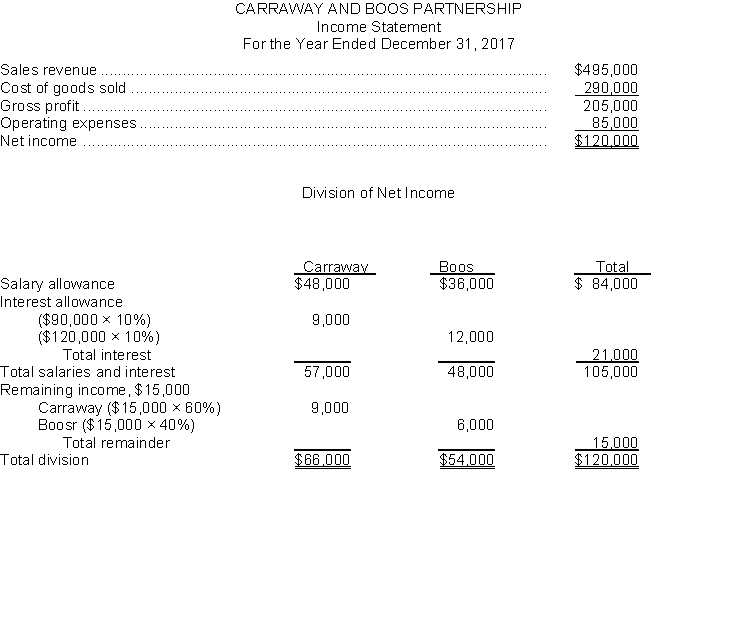

Carraway and Boos have a partnership agreement which includes the following provisions regarding sharing net income or net loss:

1. A salary allowance of $48000 to Carraway and $36000 to Boos.

2. An interest allowance of 10% on capital balances at the beginning of the year.

3. The remainder to be divided 60% to Carraway and 40% to Boos.

The capital balance on January 1 2017 for Carraway and Boos was $90000 and $120000 respectively. During 2017 the Carraway and Boos Partnership had sales of $495000 cost of goods sold of $290000 and operating expenses of $85000.

Instructions

Prepare an income statement for the Carraway and Boos Partnership for the year ended December 31 2017. As a part of the income statement include a Division of Net Income to each of the partners.

Salary Allowance

A fixed amount of money paid at regular intervals to an employee, often as a benefit over their standard salary.

Interest Allowance

A deduction or allocation of interest expense, often related to tax calculations or financial assistance programs.

Net Income

Net income refers to the total earnings of a company once all costs, taxes, and expenses have been deducted from the overall revenue.

- Compute division of net income among partners according to various agreements.

Verified Answer

Learning Objectives

- Compute division of net income among partners according to various agreements.

Related questions

Juanita Gomez and Brandi Toomey Have Formed the GT Partnership ...

Ando Dadd and Porter Formed a Partnership on January 1 ...

The Adjusted Trial Balance of the Ricci and Napoli Partnership ...

The Partnership of Smith and Jones, Who Have Average Capital ...

Emerson and Dakota Formed a Partnership Dividing Income as Follows ...