Asked by Hunain Nadeem on May 12, 2024

Verified

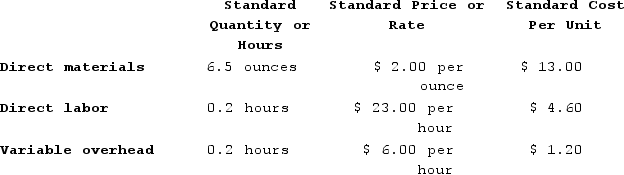

Tharaldson Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in June.

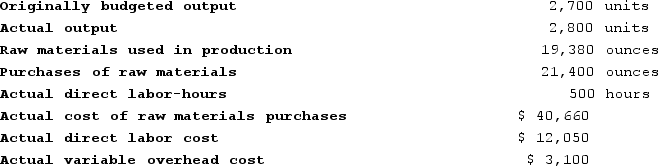

The company reported the following results concerning this product in June.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for June is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for June is:

A) $2,140 Unfavorable

B) $2,140 Favorable

C) $1,820 Unfavorable

D) $1,820 Favorable

Direct Materials

The raw materials directly used in the production of goods.

Direct Labor-Hours

The total time workers spend producing a product or service, directly involved in the manufacturing or production process.

Variable Overhead

Costs that fluctuate with the level of production output, such as utilities for a manufacturing plant, which increase as production increases.

- Perform assessments and calculations related to direct material price and quantity variances.

Verified Answer

Learning Objectives

- Perform assessments and calculations related to direct material price and quantity variances.

Related questions

Doogan Corporation Makes a Product with the Following Standard Costs ...

Doogan Corporation Makes a Product with the Following Standard Costs ...

Tharaldson Corporation Makes a Product with the Following Standard Costs ...

Milar Corporation Makes a Product with the Following Standard Costs ...

The Following Materials Standards Have Been Established for a Particular ...