Asked by CHELSEY MYERS on Apr 24, 2024

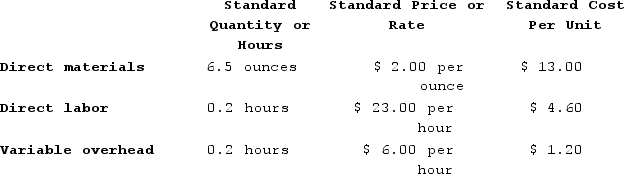

Tharaldson Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in June.

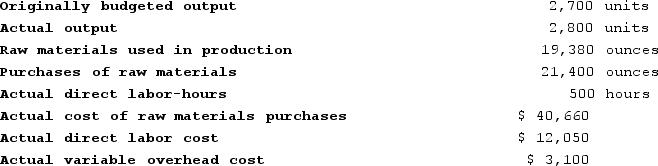

The company reported the following results concerning this product in June.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials quantity variance for June is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials quantity variance for June is:

A) $2,242 Unfavorable

B) $2,242 Favorable

C) $2,360 Unfavorable

D) $2,360 Favorable

Direct Materials

Raw materials that can be directly associated with the production of specific goods or services and are a major component of total manufacturing costs.

Direct Labor-Hours

A measure of the time workers spend directly manufacturing a product, used in calculating labor costs and efficiency.

Variable Overhead

Costs of indirect production activities that fluctuate with the level of production output, such as electricity for machinery or materials handling costs.

- Analyze and compute discrepancies in the costs of direct materials, particularly price and quantity variations.

Learning Objectives

- Analyze and compute discrepancies in the costs of direct materials, particularly price and quantity variations.

Related questions

Doogan Corporation Makes a Product with the Following Standard Costs ...

Doogan Corporation Makes a Product with the Following Standard Costs ...

Tharaldson Corporation Makes a Product with the Following Standard Costs ...

Milar Corporation Makes a Product with the Following Standard Costs ...

Solly Corporation Produces a Product for National Distribution ...