Asked by Vanessa Massie on Jun 13, 2024

Verified

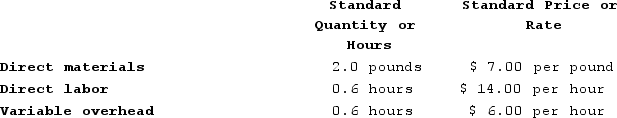

Milar Corporation makes a product with the following standard costs:  In January the company produced 4,600 units using 10,120 pounds of the direct material and 2,100 direct labor-hours. During the month, the company purchased 10,690 pounds of the direct material at a cost of $76,570. The actual direct labor cost was $38,256 and the actual variable overhead cost was $11,957.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for January is:

In January the company produced 4,600 units using 10,120 pounds of the direct material and 2,100 direct labor-hours. During the month, the company purchased 10,690 pounds of the direct material at a cost of $76,570. The actual direct labor cost was $38,256 and the actual variable overhead cost was $11,957.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for January is:

A) $1,600 Unfavorable

B) $1,740 Favorable

C) $1,740 Unfavorable

D) $1,600 Favorable

Direct Materials

Raw materials and components used in the manufacturing process that are directly incorporated into the final product.

Direct Labor-Hours

Represents the total hours worked by employees directly involved in the manufacturing process.

Variable Overhead

Costs that fluctuate with production volume, such as utilities and raw materials, contrasting with fixed overhead costs.

- Calculate and analyze direct material variances including price and quantity variances.

Verified Answer

(Actual Quantity Purchased x Actual Price) - (Actual Quantity Purchased x Standard Price)

= (10,690 x $7.17) - (10,690 x $6.80)

= $76,848.30 - $72,952

= $3,896.30 unfavorable

So the answer is C, $1,740 Unfavorable.

Learning Objectives

- Calculate and analyze direct material variances including price and quantity variances.

Related questions

Doogan Corporation Makes a Product with the Following Standard Costs ...

Doogan Corporation Makes a Product with the Following Standard Costs ...

Tharaldson Corporation Makes a Product with the Following Standard Costs ...

Tharaldson Corporation Makes a Product with the Following Standard Costs ...

The Following Materials Standards Have Been Established for a Particular ...