Asked by Emily Snoke on Jun 10, 2024

Verified

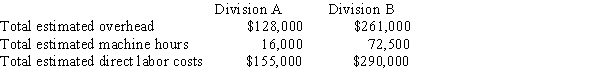

Technics Inc., a manufacturing company, utilizes job order costing. Each division establishes its own estimates regarding overhead, which are as follows:  If Division A allocates overhead on the basis of machine hours and Division B allocates overhead as a percentage of direct labor costs, what would the predetermined overhead rate be for each division?

If Division A allocates overhead on the basis of machine hours and Division B allocates overhead as a percentage of direct labor costs, what would the predetermined overhead rate be for each division?

Job Order Costing

An accounting method used to track the costs associated with producing a specific batch of products or performing a specific job.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to individual units of production, based on a selected cost driver.

Direct Labor Costs

Direct labor costs are the total expenses that a company incurs for labor directly involved in the manufacturing process of its products, including wages and salaries of the production staff.

- Calculate predetermined overhead rates based on different allocation bases.

Verified Answer

$261,000 ÷ $290,000 = 90% of direct labor costs

Learning Objectives

- Calculate predetermined overhead rates based on different allocation bases.

Related questions

Cavy Company Estimates That the Factory Overhead for the Following ...

Flagler Company Allocates Overhead Based on Machine Hours ...

The Management of Kotek Corporation Would Like to Investigate the ...

The Management of Buelow Corporation Would Like to Investigate the ...

The Management of Schneiter Corporation Would Like to Investigate the ...