Asked by Bimala Sharma Acharya on Apr 28, 2024

Verified

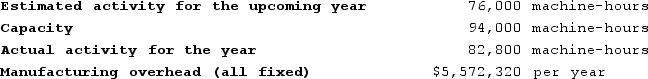

The management of Buelow Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity rather than on the estimated amount of activity for the year. The company's controller has provided an example to illustrate how this new system would work.

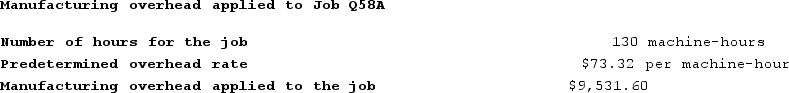

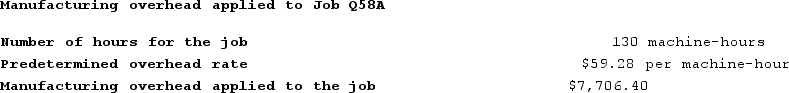

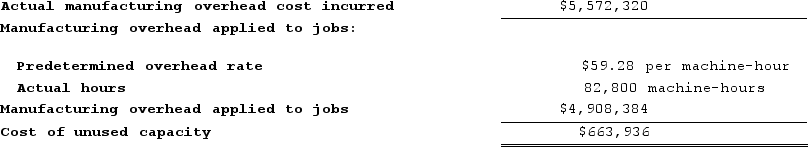

Job Q58A, which required 130 machine-hours, is one of the jobs worked on during the year.Required:a. Determine the predetermined overhead rate if the predetermined overhead rate is based on the estimated activity for the upcoming year.b. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on estimated activity for the upcoming year.c. Determine the predetermined overhead rate if the predetermined overhead rate is based on the activity at capacity.d. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on activity at capacity.e. Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity. Garrison 16e Rechecks 2019-01-30

Job Q58A, which required 130 machine-hours, is one of the jobs worked on during the year.Required:a. Determine the predetermined overhead rate if the predetermined overhead rate is based on the estimated activity for the upcoming year.b. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on estimated activity for the upcoming year.c. Determine the predetermined overhead rate if the predetermined overhead rate is based on the activity at capacity.d. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on activity at capacity.e. Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity. Garrison 16e Rechecks 2019-01-30

Predetermined Overhead Rate

A rate calculated before a production period based on estimated overhead costs and activity levels, used to allocate overhead costs to products.

Capacity

The highest amount of production a business can maintain over a specific time frame under standard conditions.

Machine-Hours

A measure of production volume or activity based on the number of hours that machines are operated.

- Gain insight into the process of calculating predetermined overhead rates by employing allocation bases like machine-hours, labor-hours, and capacity.

- Become informed about the approach to valuing the cost of dormant capacity and its implications for cost accounting practices.

- Gain insight into the methodology of establishing overhead rates premised on the notion of operating at capacity as opposed to forecasting yearly activities.

Verified Answer

c.Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $5,572,320 ÷ 94,000 machine-hours = $59.28 per machine-hourd.

c.Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $5,572,320 ÷ 94,000 machine-hours = $59.28 per machine-hourd. e.

e.

Learning Objectives

- Gain insight into the process of calculating predetermined overhead rates by employing allocation bases like machine-hours, labor-hours, and capacity.

- Become informed about the approach to valuing the cost of dormant capacity and its implications for cost accounting practices.

- Gain insight into the methodology of establishing overhead rates premised on the notion of operating at capacity as opposed to forecasting yearly activities.

Related questions

The Management of Kotek Corporation Would Like to Investigate the ...

The Management of Schneiter Corporation Would Like to Investigate the ...

Lightner Corporation Bases Its Predetermined Overhead Rate on the Estimated ...

Gercak Corporation Has Two Production Departments, Forming and Assembly ...

Flagler Company Allocates Overhead Based on Machine Hours ...