Asked by shadyra basurto on Jul 13, 2024

Verified

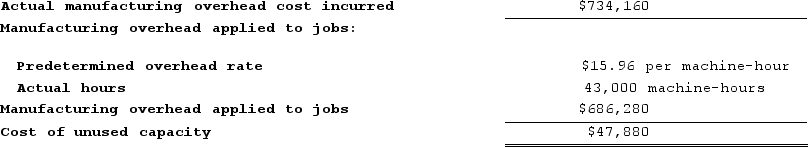

The management of Schneiter Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity rather than on the estimated amount of activity for the year. The company's controller has provided an example to illustrate how this new system would work. In this example, the allocation base is machine-hours and the estimated amount of the allocation base for the upcoming year is 42,000 machine-hours. In addition, capacity is 46,000 machine-hours and the actual activity for the year is 43,000 machine-hours. All of the manufacturing overhead is fixed and is $734,160 per year.Required:a. Determine the predetermined overhead rate if the predetermined overhead rate is based on activity at capacity.b. Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead to individual units of output.

Capacity

The maximum level of output that a company can sustain to make a product or provide a service, influenced by available resources and constraints.

Machine-Hours

The total hours a machine is operated within a given period, often used to allocate manufacturing overhead.

- Master the procedure for computing predetermined overhead rates with various allocation foundations, including machine-hours, labor-hours, and capacity.

- Familiarize yourself with the technique for appraising the cost of idle resources and the consequence on the cost management system.

- Understand the concept of basing predetermined overhead rates on activity at capacity versus estimated activity for the year.

Verified Answer

Learning Objectives

- Master the procedure for computing predetermined overhead rates with various allocation foundations, including machine-hours, labor-hours, and capacity.

- Familiarize yourself with the technique for appraising the cost of idle resources and the consequence on the cost management system.

- Understand the concept of basing predetermined overhead rates on activity at capacity versus estimated activity for the year.

Related questions

Lightner Corporation Bases Its Predetermined Overhead Rate on the Estimated ...

The Management of Buelow Corporation Would Like to Investigate the ...

The Management of Kotek Corporation Would Like to Investigate the ...

Gercak Corporation Has Two Production Departments, Forming and Assembly ...

Cavy Company Estimates That the Factory Overhead for the Following ...