Asked by Loretta Foshee on May 06, 2024

Verified

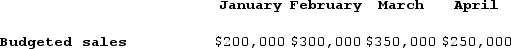

Seventy percent of Pitkin Corporation's sales are collected in the month of sale, 20% in the month following sale, and 10% in the second month following sale. The following are budgeted sales data for the company:  Total budgeted cash collections in April would be:

Total budgeted cash collections in April would be:

A) $175,000

B) $275,000

C) $70,000

D) $30,000

Budgeted Sales Data

Projections or estimates of sales for a future period, used for planning and forecasting purposes.

Cash Collections

The process of gathering all cash receipts and payments, including from sales, loans, and other transactions, over a specific period.

- Familiarize yourself with the concepts of cash collections and accounts receivable in the context of budget management.

- Analyze anticipated sales figures to deduce expected cash inflows, projected receivable accounts balance, and planned sales indices.

Verified Answer

MY

Matthew YoungMay 09, 2024

Final Answer :

B

Explanation :

To calculate the total budgeted cash collections in April, we need to determine how much of the sales from January, February, and March will be collected in April.

- For January sales, 70% would be collected in January, and 20% would be collected in February, leaving 10% to be collected in March.

- For February sales, 70% would be collected in February, 20% would be collected in March, and 10% would be collected in April.

- For March sales, 70% would be collected in March, 20% would be collected in April, and 10% would be collected in May.

Using this information, we can calculate the total budgeted cash collections in April as follows:

January sales collected in April: $200,000 x 10% = $20,000

February sales collected in April: $300,000 x 10% = $30,000

March sales collected in April: $250,000 x 20% = $50,000

Total budgeted cash collections in April: $20,000 + $30,000 + $50,000 = $100,000

However, we also need to add in the 10% of April sales that are expected to be collected in April:

April sales: $400,000 x 70% = $280,000

Collections from April sales in April: $280,000 x 70% = $196,000

Adding this to the previous total, we get:

Total budgeted cash collections in April: $100,000 + $196,000 = $296,000

However, we need to remember that 10% of March sales are also expected to be collected in April, so we need to subtract this amount:

March sales collected in April: $250,000 x 10% = $25,000

Final answer: $296,000 - $25,000 = $271,000

Therefore, the best choice is B.

- For January sales, 70% would be collected in January, and 20% would be collected in February, leaving 10% to be collected in March.

- For February sales, 70% would be collected in February, 20% would be collected in March, and 10% would be collected in April.

- For March sales, 70% would be collected in March, 20% would be collected in April, and 10% would be collected in May.

Using this information, we can calculate the total budgeted cash collections in April as follows:

January sales collected in April: $200,000 x 10% = $20,000

February sales collected in April: $300,000 x 10% = $30,000

March sales collected in April: $250,000 x 20% = $50,000

Total budgeted cash collections in April: $20,000 + $30,000 + $50,000 = $100,000

However, we also need to add in the 10% of April sales that are expected to be collected in April:

April sales: $400,000 x 70% = $280,000

Collections from April sales in April: $280,000 x 70% = $196,000

Adding this to the previous total, we get:

Total budgeted cash collections in April: $100,000 + $196,000 = $296,000

However, we need to remember that 10% of March sales are also expected to be collected in April, so we need to subtract this amount:

March sales collected in April: $250,000 x 10% = $25,000

Final answer: $296,000 - $25,000 = $271,000

Therefore, the best choice is B.

Learning Objectives

- Familiarize yourself with the concepts of cash collections and accounts receivable in the context of budget management.

- Analyze anticipated sales figures to deduce expected cash inflows, projected receivable accounts balance, and planned sales indices.

Related questions

Jeanclaude Corporation Produces and Sells One Product ...

Sirignano Corporation Produces and Sells One Product ...

Um Corporation Has Provided the Following Information Concerning Its Raw ...

The LaPann Corporation Has Obtained the Following Sales Forecast Data ...

Vinall Corporation Makes One Product and Has Provided the Following ...