Asked by devanshi mehrotra on Jun 12, 2024

Verified

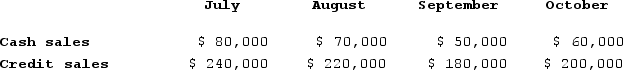

The LaPann Corporation has obtained the following sales forecast data:  The regular pattern of collection of credit sales is 20% in the month of sale, 70% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts.The budgeted accounts receivable balance on September 30 would be:

The regular pattern of collection of credit sales is 20% in the month of sale, 70% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts.The budgeted accounts receivable balance on September 30 would be:

A) $126,000

B) $148,000

C) $166,000

D) $190,000

Budgeted Accounts Receivable

The expected amount of money owed to a company by its customers for goods or services delivered, as forecasted in the budget.

Regular Pattern of Collection

A systematic approach to gathering data or information at consistent intervals.

Credit Sales

Sales transactions where the customer is allowed to pay at a later date, extending credit rather than requiring payment upfront.

- Comprehend the role of accounts receivable and payable in the management of cash budgets.

Verified Answer

July credit sales = $40,000

August credit sales = $50,000

September credit sales = $60,000

Next, we can calculate the collections for each month:

July collections = 20% of $40,000 = $8,000

August collections = 70% of ($40,000 + $50,000) = $63,000

September collections = Remaining amount = $39,000

We can now calculate the remaining accounts receivable balance for each month:

End of July = $40,000 - $8,000 = $32,000

End of August = $50,000 - $63,000 = -$13,000 (Note: this is a credit balance, representing the amount collected in advance)

End of September = $60,000 - $39,000 = $21,000

Finally, we need to add up the ending accounts receivable balances for August and September and subtract the credit balance:

Accounts Receivable on September 30 = $21,000 - $13,000 = $8,000

Therefore, the budgeted accounts receivable balance on September 30 is $166,000 (Choice C).

Learning Objectives

- Comprehend the role of accounts receivable and payable in the management of cash budgets.

Related questions

Um Corporation Has Provided the Following Information Concerning Its Raw ...

Jeanclaude Corporation Produces and Sells One Product ...

Seventy Percent of Pitkin Corporation's Sales Are Collected in the ...

Sirignano Corporation Produces and Sells One Product ...

The Quality of Receivables Refers to the Likelihood of Collection ...