Asked by Alondra Cardenas on Jul 08, 2024

Verified

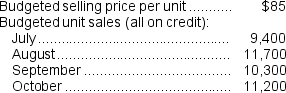

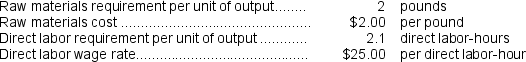

Vinall Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:

Credit sales are collected:

Credit sales are collected:

30% in the month of the sale

70% in the following month

Raw materials purchases are paid:

20% in the month of purchase

80% in the following month

The ending finished goods inventory should equal 20% of the following month's sales.The ending raw materials inventory should equal 20% of the following month's raw materials production needs.

Required:

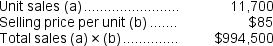

a.What are the budgeted sales for August?

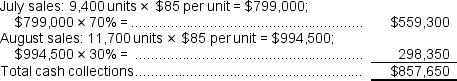

b.What are the expected cash collections for August?

c.According to the production budget, how many units should be produced in August?

d.If 20,960 pounds of raw materials are needed for production in September, how many pounds of raw materials should be purchased in August?

e.What is the estimated cost of raw materials purchases for August?

f.If the cost of raw material purchases in July is $40,688, then in August what are the total estimated cash disbursements for raw materials purchases?

g.What is the total estimated direct labor cost for August assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?

Master Budget

An integrated set of financial plans that outlines a company’s financial and operational goals for a specific period, including various component budgets like sales, production, and cash budgets.

Finished Goods Inventory

The total value of all completed products that have not yet been sold by the company.

Direct Labor

The cost of wages for employees who are directly involved in the production of goods or the provision of services.

- Learn about the key elements and processes required for constructing a master budget.

- Ascertain and clarify projections related to sales revenue, cash inflow, and pending receivables.

- Design a production financial plan, including the requisite unit production to accomplish sales and inventory aims.

Verified Answer

b.The expected cash collections for August are computed as follows:

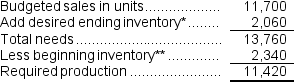

b.The expected cash collections for August are computed as follows:  c.The budgeted required production for August is computed as follows:

c.The budgeted required production for August is computed as follows:  *September sales of 10,300 units × 20% = 2,060 units

*September sales of 10,300 units × 20% = 2,060 units** August sales of 11,700 units × 20%= 2,340 units

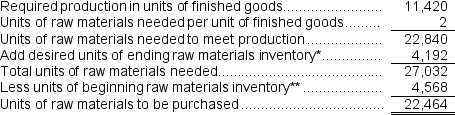

d.The budgeted raw material purchases for August are computed as follows:

* 20,960 pounds × 20% = 4,192 pounds.

* 20,960 pounds × 20% = 4,192 pounds.** 22,840 pounds × 20% = 4,568 pounds.

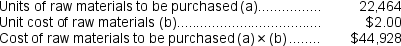

e.The budgeted cost of raw material purchases for August is computed as follows:

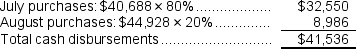

f.The estimated cash disbursements for materials purchases in August is computed as follows:

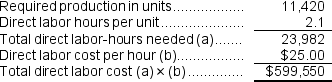

f.The estimated cash disbursements for materials purchases in August is computed as follows:  g.The estimated direct labor cost for August is computed as follows:

g.The estimated direct labor cost for August is computed as follows:

Learning Objectives

- Learn about the key elements and processes required for constructing a master budget.

- Ascertain and clarify projections related to sales revenue, cash inflow, and pending receivables.

- Design a production financial plan, including the requisite unit production to accomplish sales and inventory aims.

Related questions

Romeiro Corporation Is Preparing Its Cash Budget for September ...

Mumbower Corporation Makes One Product and Has Provided the Following ...

Brockney Inc ...

Weller Industrial Gas Corporation Supplies Acetylene and Other Compressed Gases ...

LBC Corporation Makes and Sells a Product Called Product WZ ...