Asked by Hannah Hanson on Jun 12, 2024

Verified

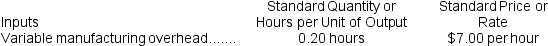

Sade Inc.has provided the following data concerning one of the products in its standard cost system.Variable manufacturing overhead is applied to products on the basis of direct labor-hours.  The company has reported the following actual results for the product for December:

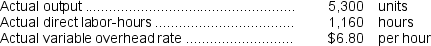

The company has reported the following actual results for the product for December:  Required:

Required:

a.Compute the variable overhead rate variance for December.

b.Compute the variable overhead efficiency variance for December.

Variable Overhead

Costs that vary with the level of production or sales, such as utilities or commissions, but not directly tied to specific units.

Direct Labor-Hours

The total hours of labor directly involved in producing goods, used as a base to allocate labor costs to products.

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the standard cost of variable overhead allotted based on the activity level.

- Comprehend the methodology for computing different variances within a standard cost framework, encompassing materials, labor, and overhead discrepancies.

- Understand the various forms of variances including price, quantity, rate, and efficiency.

- Cultivate abilities to interpret the consequences of discrepancies in managerial decision-making.

Verified Answer

= AH × (AR - SR)

= 1,160 hours × ($6.80 per hour - $7.00 per hour)

= 1,160 hours × (-$0.20 per hour)

= $232 F

b.SH = 5,300 units × 0.20 hours per unit = 1,060 hours

Variable overhead efficiency variance = (AH × SR)- (SH × SR)

= (AH - SH)× SR

= (1,160 hours - 1,060 hours)× $7.00 per hour

= (100 hours)× $7.00 per hour

= $700 U

Learning Objectives

- Comprehend the methodology for computing different variances within a standard cost framework, encompassing materials, labor, and overhead discrepancies.

- Understand the various forms of variances including price, quantity, rate, and efficiency.

- Cultivate abilities to interpret the consequences of discrepancies in managerial decision-making.

Related questions

Freytag Corporation's Variable Overhead Is Applied on the Basis of ...

Reagen Corporation Makes a Product with the Following Standard Costs ...

Lemke Corporation Uses a Standard Cost System in Which Inventories ...

Dews Corporation Manufactures One Product ...

Robnett Corporation Manufactures One Product ...