Asked by Gabrielle D'Andrea on May 17, 2024

Verified

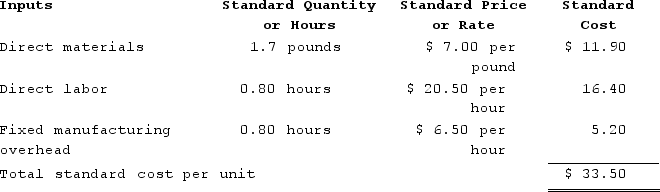

Lemke Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. The standard cost card for the company's only product is as follows:  During the year, the company started and completed 12,300 units. Direct labor employees worked 10,540 hours at an average cost of $22.40 per hour.Assume that all transactions are recorded on a worksheet as shown in the text. On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and Property, Plant, and Equipment (net) . All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.When the direct labor cost is recorded, which of the following entries will be made?

During the year, the company started and completed 12,300 units. Direct labor employees worked 10,540 hours at an average cost of $22.40 per hour.Assume that all transactions are recorded on a worksheet as shown in the text. On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and Property, Plant, and Equipment (net) . All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.When the direct labor cost is recorded, which of the following entries will be made?

A) $20,026 in the Labor Efficiency Variance column

B) $20,026 in the Labor Rate Variance column

C) ($20,026) in the Labor Rate Variance column

D) ($20,026) in the Labor Efficiency Variance column

Labor Efficiency Variance

The difference between the actual labor hours used and the standard hours expected for the level of production achieved.

Direct Labor

The cost of workers who are directly involved in the production of goods or the delivery of services.

Standard Cost System

An accounting method that assigns predetermined costs to products and services, which are then compared to actual costs to measure performance.

- Review the processes for calculating variances in standard costing setups, targeting material, labor, and overhead discrepancies.

- Interpret how divergences such as price, quantity, efficiency, and budget affect strategic financial planning.

Verified Answer

10,540 hours x ($22.40 - $20) = $26,544 favorable

Since the standard cost system records variances directly to Cost of Goods Sold, a favorable variance would result in a credit to Cost of Goods Sold. Therefore, the entry would be:

Labor Rate Variance = $26,544 CR

Cost of Goods Sold = $26,544 DR

However, the question asks for the entry when the direct labor cost is recorded. The total direct labor cost is calculated as Actual Hours Worked x Actual Hourly Rate, which in this case is:

10,540 hours x $22.40 = $235,456

Since the labor rate variance is favorable, this means that the actual hourly rate is lower than the standard hourly rate. Therefore, the actual labor cost is lower than the standard labor cost, resulting in a favorable variance. To adjust the actual labor cost to the standard labor cost, we subtract the labor rate variance from the actual labor cost:

Actual Labor Cost - Labor Rate Variance = Standard Labor Cost

$235,456 - $26,544 = $208,912

Therefore, the entry when the direct labor cost is recorded is:

Work In Process = $208,912 DR (to record the standard cost of direct labor)

Labor Rate Variance = $26,544 CR (to record the favorable variance)

Wages Payable = $235,456 CR (to record the actual wages paid)

Learning Objectives

- Review the processes for calculating variances in standard costing setups, targeting material, labor, and overhead discrepancies.

- Interpret how divergences such as price, quantity, efficiency, and budget affect strategic financial planning.

Related questions

Neuhaus Corporation Manufactures One Product ...

Dews Corporation Manufactures One Product ...

Reagen Corporation Makes a Product with the Following Standard Costs ...

Freytag Corporation's Variable Overhead Is Applied on the Basis of ...

Sade IncHas Provided the Following Data Concerning One of the ...