Asked by Maritza Cabrera on May 18, 2024

Verified

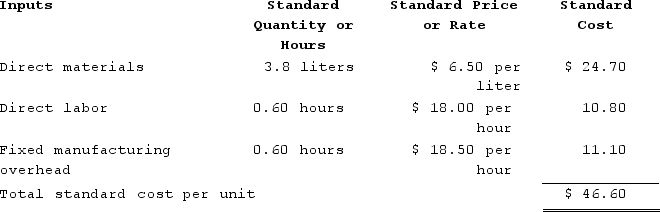

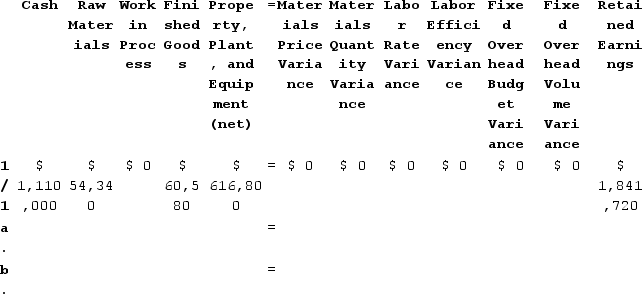

Robnett Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:  During the year, the company completed the following transactions:a. Purchased 106,900 liters of raw material at a price of $6.80 per liter.b. Used 93,760 liters of the raw material to produce 24,700 units of work in process.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

During the year, the company completed the following transactions:a. Purchased 106,900 liters of raw material at a price of $6.80 per liter.b. Used 93,760 liters of the raw material to produce 24,700 units of work in process.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When the purchase of raw materials is recorded in transaction (a) above, which of the following entries will be made?

When the purchase of raw materials is recorded in transaction (a) above, which of the following entries will be made?

A) $32,070 in the Materials Price Variance column

B) ($32,070) in the Materials Quantity Variance column

C) $32,070 in the Materials Quantity Variance column

D) ($32,070) in the Materials Price Variance column

Materials Price Variance

The difference between the actual cost of direct materials and the standard cost multiplied by the actual quantity purchased or used.

Raw Materials

Basic materials used in the production or manufacturing process, before being transformed into finished goods.

Work in Process

Goods that are in the midst of being produced, representing inventory that is not yet fully completed.

- Conduct evaluations and analyses on variances from set cost baselines, highlighting variations in material costs, differences in material consumption, labor rate differences, labor efficiency differences, fixed overhead budget variations, and fixed overhead volume variations.

- Chronicle the acquisition and deployment of raw materials.

Verified Answer

RP

Raahim PathanMay 18, 2024

Final Answer :

D

Explanation :

The standard cost for raw materials is $6.50 per liter ($4.00 + $2.50), but the company actually paid $6.80 per liter. The Materials Price Variance is calculated as (Actual Price - Standard Price) x Actual Quantity, which in this case is ($6.80 - $6.50) x 106,900 = $32,070 unfavorable. Therefore, the entry will be ($32,070) in the Materials Price Variance column.

Learning Objectives

- Conduct evaluations and analyses on variances from set cost baselines, highlighting variations in material costs, differences in material consumption, labor rate differences, labor efficiency differences, fixed overhead budget variations, and fixed overhead volume variations.

- Chronicle the acquisition and deployment of raw materials.