Asked by Tatum Briggs on May 17, 2024

Verified

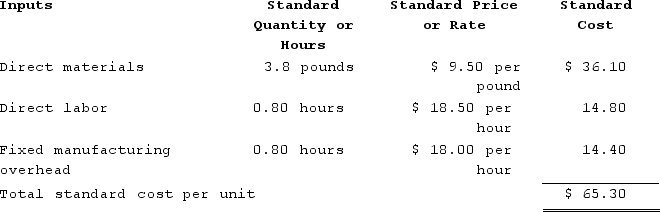

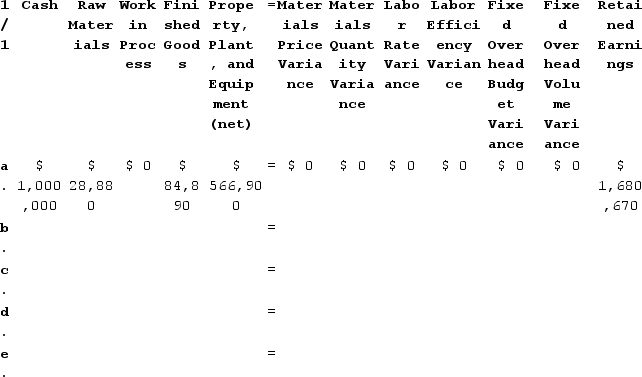

Robins Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.During the year, the company completed the following transactions:Purchased 134,700 pounds of raw material at a price of $9.10 per pound.Used 122,080 pounds of the raw material to produce 32,100 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 26,680 hours at an average cost of $17.20 per hour.Applied fixed overhead to the 32,100 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $378,400. Of this total, $297,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $81,000 related to depreciation of manufacturing equipment.Completed and transferred 32,100 units from work in process to finished goods.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.During the year, the company completed the following transactions:Purchased 134,700 pounds of raw material at a price of $9.10 per pound.Used 122,080 pounds of the raw material to produce 32,100 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 26,680 hours at an average cost of $17.20 per hour.Applied fixed overhead to the 32,100 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $378,400. Of this total, $297,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $81,000 related to depreciation of manufacturing equipment.Completed and transferred 32,100 units from work in process to finished goods.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the raw materials purchases in transaction (a) above, the Cash account will increase (decrease) by:

When recording the raw materials purchases in transaction (a) above, the Cash account will increase (decrease) by:

A) ($1,279,650)

B) ($1,225,770)

C) $1,279,650

D) $1,225,770

Standard Cost System

A cost accounting system that uses cost estimates for materials, labor, and overhead to assess performance by comparing these standard costs to actual costs incurred.

Work in Process

Inventory comprising goods that are in the production process but not yet completed.

Raw Material

Basic materials used in the production process to manufacture goods, often processed in multiple stages to produce the final product.

- Perform calculations and critical examination of discrepancies from traditional cost standards, featuring variances in material prices, material quantity variances, variations in labor pricing, efficiency variations in labor, deviations in fixed overhead budgeting, and deviations in fixed overhead volume.

- Record purchases and usage of raw materials.

Verified Answer

RV

Rowall vasquezMay 18, 2024

Final Answer :

B

Explanation :

The raw materials purchases will be recorded as an increase in the Raw Materials account and a decrease in the Cash account. The calculation is as follows:

134,700 pounds x $9.10 per pound = $1,225,770 decrease in Cash account. Therefore, the answer is B.

134,700 pounds x $9.10 per pound = $1,225,770 decrease in Cash account. Therefore, the answer is B.

Learning Objectives

- Perform calculations and critical examination of discrepancies from traditional cost standards, featuring variances in material prices, material quantity variances, variations in labor pricing, efficiency variations in labor, deviations in fixed overhead budgeting, and deviations in fixed overhead volume.

- Record purchases and usage of raw materials.