Asked by Preet Sangha on Jun 04, 2024

Verified

Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below,prepare the adjusting journal entries for Highlight Styling.

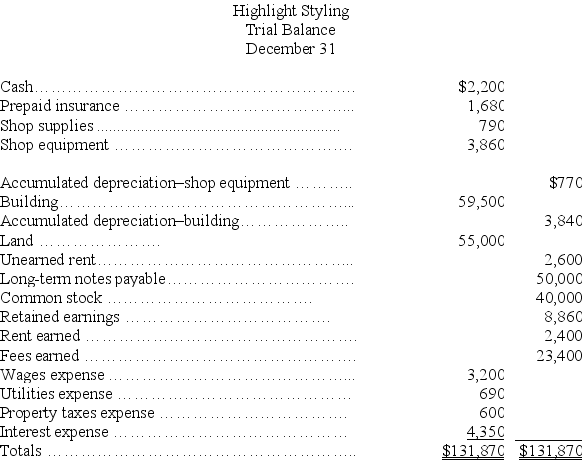

Highlight Stylings' unadjusted trial balance\bold{\text{unadjusted trial balance}}unadjusted trial balance for the current year follows:

Additional information:

Additional information:

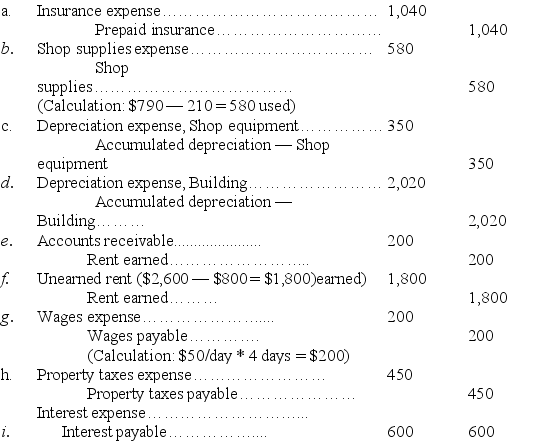

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Unadjusted Trial Balance

A financial document listing all the accounts and their balances at a particular date, before any adjustments are made.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting wear and tear, or obsolescence.

Accrued Revenues

Revenues earned in an accounting period that have not yet been received in cash or recorded at the statement date.

- Learn and execute the preparation processes of journal entries for different accounting operations.

- Understand the significance of precise adjustments to trial balances and their impact on financial statements.

Verified Answer

Learning Objectives

- Learn and execute the preparation processes of journal entries for different accounting operations.

- Understand the significance of precise adjustments to trial balances and their impact on financial statements.

Related questions

Record the December 31 Adjusting Entries for the Following Transactions ...

The Following Unadjusted and Adjusted Trial Balances Are from the ...

Werner Company Had $1,300 of Store Supplies at the Beginning ...

Trapper Company's Unadjusted and Adjusted Trial Balances on December 31 ...

For Each of the Following Two Separate Situations,present Both the ...