Asked by Cristina Elena on May 06, 2024

Verified

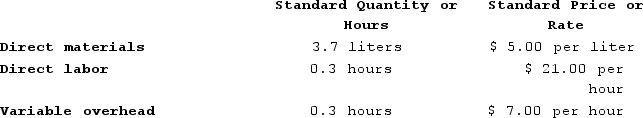

Reagen Corporation makes a product with the following standard costs:

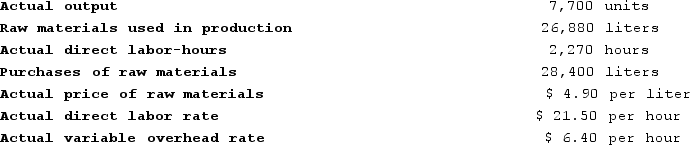

The company reported the following results concerning this product in December.

The company reported the following results concerning this product in December.

The materials price variance is recognized when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

The materials price variance is recognized when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

Required:a. Compute the materials quantity variance.b. Compute the materials price variance.c. Compute the labor efficiency variance.d. Compute the labor rate variance.e. Compute the variable overhead efficiency variance.f. Compute the variable overhead rate variance.

Materials Price Variance

The difference between the actual cost of materials purchased and the expected (standard) cost, multiplied by the quantity of materials.

Labor Efficiency Variance

A measure used to assess the difference between the actual hours worked and the standard hours allotted to complete a task, multiplied by the standard hourly labor rate.

Variable Overhead

Refers to the indirect costs of operation that fluctuate with the level of production activity, such as utilities for manufacturing facilities.

- Estimate several forms of variances, including those related to the price and quantity of materials.

- Measure variances between labor rate and labor efficiency.

- Establish the variable overhead rate and scrutinize efficiency discrepancies.

Verified Answer

b. Materials price variance = Actual quantity × (Actual price − Standard price)= 28,400 liters × ($4.90 per liter − $5.00 per liter)= 28,400 liters × (−$0.10 per liter)= $2,840 Favorable

c. Standard hours = 7,700 units × 0.3 hours per unit = 2,310 hoursLabor efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)= (2,270 hours × $21.00 per hour) − (2,310 hours × $21.00 per hour)= $47,670 − $48,510= $840 Favorable

d. Labor rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)= (2,270 hours × $21.50 per hour) − (2,270 hours × $21.00 per hour)= $48,805 − $47,670= $1,135 Unfavorable

e. Standard hours = 7,700 units × 0.3 hours per unit = 2,310 hoursVariable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate= (2,270 hours − 2,310 hours) × $7.00 per hour= (−40 hours) × $7.00 per hour= $280 Favorable

f. Variable overhead rate variance = Actual hours × (Actual rate − Standard rate)= 2,270 hours × ($6.40 per hour − $7.00 per hour)= 2,270 hours × (−$0.60 per hour)= $1,362 Favorable

Learning Objectives

- Estimate several forms of variances, including those related to the price and quantity of materials.

- Measure variances between labor rate and labor efficiency.

- Establish the variable overhead rate and scrutinize efficiency discrepancies.

Related questions

Bondi Corporation Makes Automotive Engines ...

Mirabito Incorporated Has Provided the Following Data Concerning One of ...

Freytag Corporation's Variable Overhead Is Applied on the Basis of ...

Glaab Incorporated Has Provided the Following Data Concerning One of ...

Flick Company Uses a Standard Cost System in Which Manufacturing ...