Asked by La Vida de una Guerrera on May 22, 2024

Verified

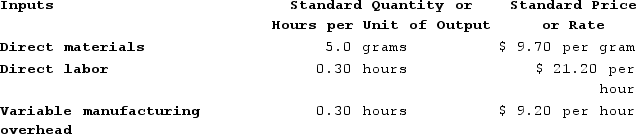

Mirabito Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

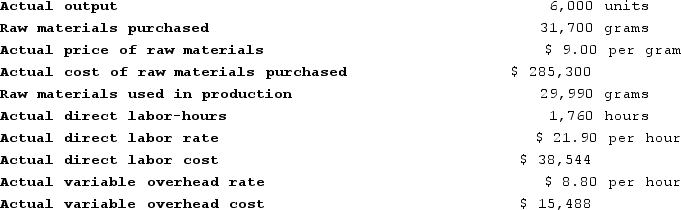

The company has reported the following actual results for the product for December:

The company has reported the following actual results for the product for December:

Required:

Required:

a. Compute the materials price variance for December.

b. Compute the materials quantity variance for December.

c. Compute the labor rate variance for December.

d. Compute the labor efficiency variance for December.

e. Compute the variable overhead rate variance for December.

f. Compute the variable overhead efficiency variance for December.

Materials Price Variance

The variance between the real expenses incurred from direct materials in manufacturing and the anticipated standard cost of those materials.

Labor Rate Variance

The discrepancy between what labor actually costs and what was originally forecasted or considered standard.

Variable Manufacturing

Costs that change in direct proportion to changes in the volume of production output.

- Calculate various types of variances such as materials price and quantity variances.

- Determine labor rate and labor efficiency variances.

- Uncover the variable overhead rate and explore efficiency discrepancies.

Verified Answer

= Actual quantity × (Actual price − Standard price)

= 31,700 grams × ($9.00 per gram − $9.70 per gram)

= 31,700 grams × (−$0.70 per gram)

= $22,190 Favorable

b. Standard quantity = 6,000 units × 5.0 grams per unit = 30,000 grams

Materials quantity variance = (Actual quantity × Standard price) − (Standard quantity × Standard price)

= (Actual quantity − Standard quantity) × Standard price

= (29,990 grams − 30,000 grams) × $9.70 per gram

= −10 grams × $9.70 per gram

= $97 Favorable

c. Labor rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 1,760 hours × ($21.90 per hour − $21.20 per hour)

= 1,760 hours × ($0.70 per hour)

= $1,232 Unfavorable

d. Standard hours = 6,000 units × 0.30 hours per unit = 1,800 hours

Labor efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (1,760 hours − 1,800 hours) × $21.20 per hour

= (−40 hours) × $21.20 per hour

= $848 Favorable

e. Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 1,760 hours × ($8.80 per hour − $9.20 per hour)

= 1,760 hours × (−$0.40 per hour)

= $704 Favorable

f. Standard hours = 6,000 units × 0.30 hours per unit = 1,800 hours

Variable overhead efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (1,760 hours − 1,800 hours) × $9.20 per hour

= (−40 hours) × $9.20 per hour

= $368 Favorable

Learning Objectives

- Calculate various types of variances such as materials price and quantity variances.

- Determine labor rate and labor efficiency variances.

- Uncover the variable overhead rate and explore efficiency discrepancies.

Related questions

Bondi Corporation Makes Automotive Engines ...

Creger Corporation, Which Makes Landing Gears, Has Provided the Following ...

Glaab Incorporated Has Provided the Following Data Concerning One of ...

Freytag Corporation's Variable Overhead Is Applied on the Basis of ...

Kropf Incorporated Has Provided the Following Data Concerning One of ...