Asked by Cashmere Wilson on Jun 13, 2024

Verified

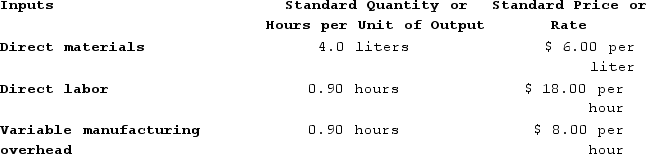

Glaab Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

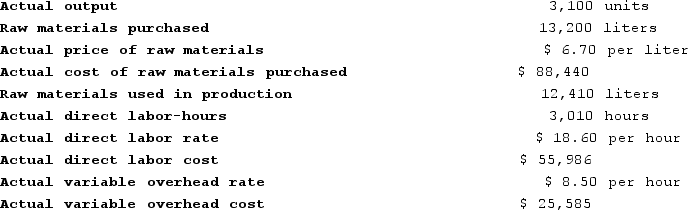

The company has reported the following actual results for the product for September:

The company has reported the following actual results for the product for September:

Required:

Required:

a. Compute the materials price variance for September.

b. Compute the materials quantity variance for September.

c. Compute the labor rate variance for September.

d. Compute the labor efficiency variance for September.

e. Compute the variable overhead rate variance for September.

f. Compute the variable overhead efficiency variance for September.

Materials Price Variance

The deviation between the actual cost of direct materials and the standard cost, multiplied by the quantity purchased.

Variable Overhead Rate

The rate at which variable overhead costs are allocated to a unit of production, often based on direct labor hours or machine hours.

- Carry out the computation of assorted variance types, encompassing the discrepancies in price and quantity of materials.

- Evaluate the divergence in labor rate and labor efficiency metrics.

- Identify the rate of variable overhead and analyze variances in efficiency.

Verified Answer

JS

James StewartJun 16, 2024

Final Answer :

a. Materials price variance = (Actual quantity × Actual price) − (Actual quantity × Standard price)

= Actual quantity × (Actual price − Standard price)

= 13,200 liters × ($6.70 per liter − $6.00 per liter)

= 13,200 liters × ($0.70 per liter)

= $9,240 Unfavorable

b. Standard quantity = 3,100 units × 4.0 liters per unit = 12,400 liters

Materials quantity variance = (Actual quantity × Standard price) − (Standard quantity × Standard price)

= (Actual quantity − Standard quantity) × Standard price

= (12,410 liters − 12,400 liters) × $6.00 per liter

= 10 liters × $6.00 per liter

= $60 Unfavorable

c. Labor rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 3,010 hours × ($18.60 per hour − $18.00 per hour)

= 3,010 hours × ($0.60 per hour)

= $1,806 Unfavorable

d. Standard hours = 3,100 units × 0.90 hours per unit = 2,790 hours

Labor efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (3,010 hours − 2,790 hours) × $18.00 per hour

= (220 hours) × $18.00 per hour

= $3,960 Unfavorable

e. Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 3,010 hours × ($8.50 per hour − $8.00 per hour)

= 3,010 hours × ($0.50 per hour)

= $1,505 Unfavorable

f. Standard hours = 3,100 units × 0.90 hours per unit = 2,790 hours

Variable overhead efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (3,010 hours − 2,790 hours) × $8.00 per hour

= (220 hours) × $8.00 per hour

= $1,760 Unfavorable

= Actual quantity × (Actual price − Standard price)

= 13,200 liters × ($6.70 per liter − $6.00 per liter)

= 13,200 liters × ($0.70 per liter)

= $9,240 Unfavorable

b. Standard quantity = 3,100 units × 4.0 liters per unit = 12,400 liters

Materials quantity variance = (Actual quantity × Standard price) − (Standard quantity × Standard price)

= (Actual quantity − Standard quantity) × Standard price

= (12,410 liters − 12,400 liters) × $6.00 per liter

= 10 liters × $6.00 per liter

= $60 Unfavorable

c. Labor rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 3,010 hours × ($18.60 per hour − $18.00 per hour)

= 3,010 hours × ($0.60 per hour)

= $1,806 Unfavorable

d. Standard hours = 3,100 units × 0.90 hours per unit = 2,790 hours

Labor efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (3,010 hours − 2,790 hours) × $18.00 per hour

= (220 hours) × $18.00 per hour

= $3,960 Unfavorable

e. Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= Actual hours × (Actual rate − Standard rate)

= 3,010 hours × ($8.50 per hour − $8.00 per hour)

= 3,010 hours × ($0.50 per hour)

= $1,505 Unfavorable

f. Standard hours = 3,100 units × 0.90 hours per unit = 2,790 hours

Variable overhead efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (3,010 hours − 2,790 hours) × $8.00 per hour

= (220 hours) × $8.00 per hour

= $1,760 Unfavorable

Learning Objectives

- Carry out the computation of assorted variance types, encompassing the discrepancies in price and quantity of materials.

- Evaluate the divergence in labor rate and labor efficiency metrics.

- Identify the rate of variable overhead and analyze variances in efficiency.

Related questions

Bondi Corporation Makes Automotive Engines ...

Creger Corporation, Which Makes Landing Gears, Has Provided the Following ...

Boldrin Incorporated Has a Standard Cost System ...

Freytag Corporation's Variable Overhead Is Applied on the Basis of ...

Kropf Incorporated Has Provided the Following Data Concerning One of ...