Asked by Ethan Berumen on Jun 18, 2024

Verified

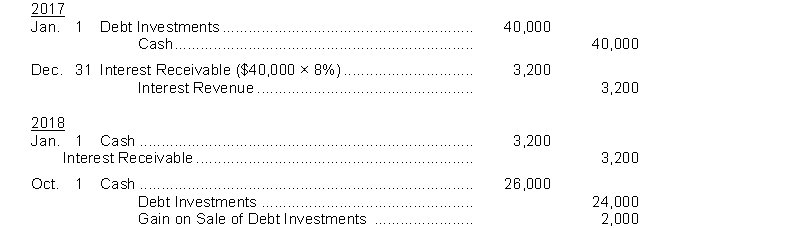

Quagle Company had the following transactions pertaining to debt investments.

2017

Jan. 1 Purchased 40 8% $1000 Steve Company bonds for $40000 cash. Interest is payable annually on January 1.

Dec. 31 Accrued annual interest on Steve Company bonds.

2018

Jan. 1 Received interest from Steve Company bonds.

Jan. 1 Sold 24 Steve Company bonds for $26000.

Instructions

Journalize the transactions.

Debt Investments

Investments in bonds or other debt securities where the investor lends money to an entity in exchange for interest payments and the return of principal.

Accrued Annual Interest

Interest that has been incurred but not yet paid over a year, representing a liability for the borrower.

Sold Bonds

The action of issuing bonds to investors, raising capital by incurring long-term debt.

- Master the concepts related to recording purchases of equity and debt investments in accounting.

- Investigate the consequences of dividends received and interest accumulation on investments in regard to financial reporting.

- Fathom the effect of divesting segments of investments, entailing the calculation of profits or deficits.

Verified Answer

Learning Objectives

- Master the concepts related to recording purchases of equity and debt investments in accounting.

- Investigate the consequences of dividends received and interest accumulation on investments in regard to financial reporting.

- Fathom the effect of divesting segments of investments, entailing the calculation of profits or deficits.

Related questions

On April 25 Davis Company Buys 4200 Shares of Carter ...

Presented Below Are Two Independent Situations ...

Pincher Company Purchased 50 Issac Company 12% 10-Year $1000 Bonds ...

Rosco Company Purchased 35000 Shares of Common Stock of Paxton ...

On February 1 Brutus Company Purchased 1000 Shares (2% Ownership) ...