Asked by Bryan Velasquez Beltran on May 20, 2024

Verified

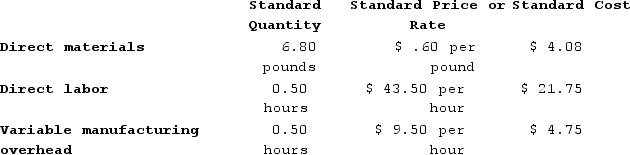

Puvo, Incorporated, manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product:  During March, the following activity was recorded by the company:The company produced 3,400 units during the month.A total of 20,400 pounds of material were purchased at a cost of $14,580.There was no beginning inventory of materials on hand to start the month; at the end of the month, 4,620 pounds of material remained in the warehouse.During March, 1,190 direct labor-hours were worked at a rate of $40.50 per hour.Variable manufacturing overhead costs during March totaled $15,061.The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for March is:

During March, the following activity was recorded by the company:The company produced 3,400 units during the month.A total of 20,400 pounds of material were purchased at a cost of $14,580.There was no beginning inventory of materials on hand to start the month; at the end of the month, 4,620 pounds of material remained in the warehouse.During March, 1,190 direct labor-hours were worked at a rate of $40.50 per hour.Variable manufacturing overhead costs during March totaled $15,061.The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for March is:

A) $3,756 Favorable

B) $4,310 Unfavorable

C) $4,310 Favorable

D) $3,756 Unfavorable

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the standard cost assigned to those overheads, indicating efficiency in managing variable costs.

Direct Materials Purchases Variance

the difference between the actual cost of direct materials purchased and the expected (or standard) cost, indicating how effectively a company is managing its resources.

Standard Labor-Hours

A pre-determined measure of the amount of labor time expected to complete a single unit of production or perform a task, often used in cost accounting.

- Detect and assess variations within variable manufacturing overhead, especially regarding rate and efficiency variances.

Verified Answer

First, we need to calculate the standard variable overhead rate per hour:

Standard variable overhead rate per hour = Total standard variable overhead costs / Total standard direct labor-hours

Standard variable overhead rate per hour = $28,900 / 1,100 = $26.27 per direct labor-hour

Next, we need to calculate the actual variable overhead rate per hour:

Actual variable overhead rate per hour = Actual variable overhead costs / Actual direct labor-hours

Actual variable overhead rate per hour = $15,061 / 1,190 = $12.67 per direct labor-hour

Finally, we can calculate the variable overhead rate variance:

Variable overhead rate variance = (Standard variable overhead rate per hour - Actual variable overhead rate per hour) x Actual direct labor-hours

Variable overhead rate variance = ($26.27 - $12.67) x 1,190 = $3,756 Unfavorable

Therefore, the correct answer is D, $3,756 Unfavorable.

Learning Objectives

- Detect and assess variations within variable manufacturing overhead, especially regarding rate and efficiency variances.

Related questions

Majer Corporation Makes a Product with the Following Standard Costs ...

Majer Corporation Makes a Product with the Following Standard Costs ...

If Variable Manufacturing Overhead Is Applied on the Basis of ...

The Following Standards for Variable Manufacturing Overhead Have Been Established ...

The Unitization of Fixed Overhead Costs Is Useful from a ...