Asked by Jared Jacobson on May 01, 2024

Verified

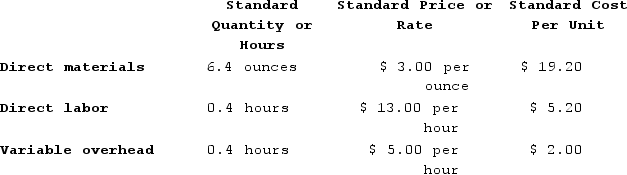

Majer Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in February.

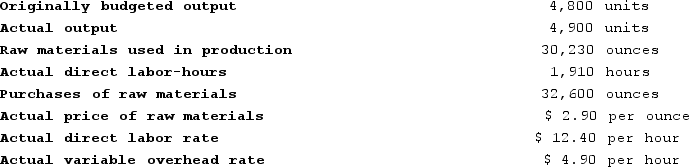

The company reported the following results concerning this product in February.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for February is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for February is:

A) $191 Unfavorable

B) $191 Favorable

C) $196 Unfavorable

D) $196 Favorable

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the standard variable overhead allocated to produced goods, based on the standard variable overhead rate.

Direct Materials Purchases Variance

The difference between the actual cost of direct material purchases and the expected (or standard) cost, adjusted for volume purchased.

Standard Costs

Predetermined costs for materials, labor, and overhead used in budgeting and assessing performance.

- Determine and compute variations in variable manufacturing overhead, focusing on both rate and efficiency discrepancies.

Verified Answer

Actual variable overhead rate = $3,940 ÷ 980 = $4.00 per hour

Standard variable overhead rate = $3.80 per hour

Actual hours worked = 960

Variable overhead rate variance = (Actual hours worked x (Actual rate - Standard rate))

= (960 x ($4.00 - $3.80))

= $192

Since the actual variable overhead rate was $0.01 lower than the standard rate, the variance is favorable. Therefore, the correct answer is B) $191 Favorable.

Learning Objectives

- Determine and compute variations in variable manufacturing overhead, focusing on both rate and efficiency discrepancies.

Related questions

Puvo, Incorporated, Manufactures a Single Product in Which Variable Manufacturing ...

Majer Corporation Makes a Product with the Following Standard Costs ...

If Variable Manufacturing Overhead Is Applied on the Basis of ...

The Following Standards for Variable Manufacturing Overhead Have Been Established ...

The Unitization of Fixed Overhead Costs Is Useful from a ...