Asked by Tatum Briggs on Jun 26, 2024

Verified

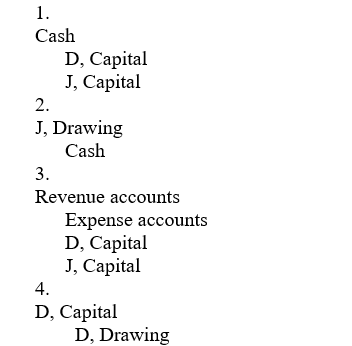

Prepare journal entries,with account titles only and without dollar amounts,for each of the following DJ Partnership transactions:

1.D and J each contribute cash into the partnership in exchange for capital.

2.D makes a cash withdrawal from the partnership.

3.Partnership net income is allocated to the partners' capital accounts.

4.D's drawing account is closed.

Partnership

A Partnership is a legal form of business operation between two or more individuals who share management and profits.

Capital Accounts

Accounts on a company's balance sheet that represent the cumulative amount of equity invested by shareholders and retained earnings.

Net Income

The profit of a company after all expenses and taxes have been deducted from total revenue.

- Prepare journal entries for partnership transactions, including capital contribution, withdrawals, income allocation, and closing of drawing accounts.

Verified Answer

CK

Learning Objectives

- Prepare journal entries for partnership transactions, including capital contribution, withdrawals, income allocation, and closing of drawing accounts.