Asked by grace kelly on Jun 24, 2024

Verified

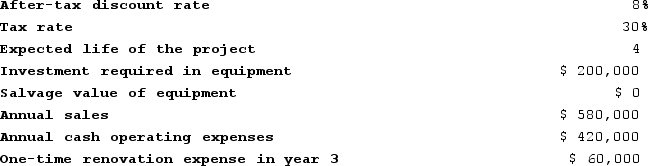

Podratz Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

A) $61,500

B) $127,000

C) $85,000

D) $100,000

Initial Investments

The upfront sum of money invested in a project, business, or asset to start its operation.

Income Taxes

Taxes imposed by governments on the income generated by businesses and individuals within their jurisdiction.

- Calculate and discuss the total net cash flow, after income tax deductions, throughout the different annual periods of a project's timeline.

- Gain an understanding of the role depreciation plays in modifying cash flows and tax dues during the process of capital budgeting determinations.

Verified Answer

AI

ABAALA IKARAJun 26, 2024

Final Answer :

C

Explanation :

To calculate the total cash flow net of income taxes in year 3, we need to calculate the operating cash flow, taxes paid or saved, and the salvage value.

Year 3 operating cash flow:

$178,000 + $5,000 - $65,000 - $26,000 - $7,000 - $20,000 = $65,000

Taxes paid or saved:

($178,000 - $65,000) * 0.35 = $44,150 tax savings

Salvage value:

$30,000 pre-tax salvage value * (1 - 0.35) = $19,500 after-tax salvage value

Total cash flow net of income taxes in Year 3:

$65,000 + $44,150 + $19,500 = $128,650

However, we need to subtract the depreciation tax shield (which is the tax savings resulting from the depreciation expense) to calculate the final answer:

Depreciation tax shield:

$125,000/5 = $25,000 annual depreciation

$25,000 * 0.35 = $8,750 tax savings due to depreciation

$128,650 - $8,750 = $119,900

Therefore, the total cash flow net of income taxes in year 3 is $85,000 (Option C).

Year 3 operating cash flow:

$178,000 + $5,000 - $65,000 - $26,000 - $7,000 - $20,000 = $65,000

Taxes paid or saved:

($178,000 - $65,000) * 0.35 = $44,150 tax savings

Salvage value:

$30,000 pre-tax salvage value * (1 - 0.35) = $19,500 after-tax salvage value

Total cash flow net of income taxes in Year 3:

$65,000 + $44,150 + $19,500 = $128,650

However, we need to subtract the depreciation tax shield (which is the tax savings resulting from the depreciation expense) to calculate the final answer:

Depreciation tax shield:

$125,000/5 = $25,000 annual depreciation

$25,000 * 0.35 = $8,750 tax savings due to depreciation

$128,650 - $8,750 = $119,900

Therefore, the total cash flow net of income taxes in year 3 is $85,000 (Option C).

Learning Objectives

- Calculate and discuss the total net cash flow, after income tax deductions, throughout the different annual periods of a project's timeline.

- Gain an understanding of the role depreciation plays in modifying cash flows and tax dues during the process of capital budgeting determinations.

Related questions

Mesko Corporation Has Provided the Following Information Concerning a Capital ...

Since Depreciation Is a Noncash Charge,it Neither Appears On,nor Has ...

Given the Following Information, Calculate OCF at the Accounting Break-Even ...

The Amount of the Estimated Average Income for a Proposed ...

Mesko Corporation Has Provided the Following Information Concerning a Capital ...