Asked by Dangerously Loved on Jul 01, 2024

Verified

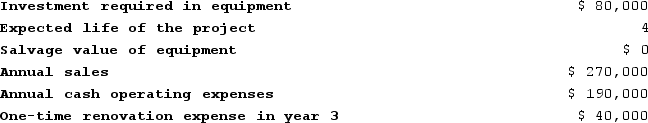

Mesko Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

A) $12,000

B) $18,000

C) $6,000

D) $24,000

Income Tax Expense

The total amount of income tax a company is obligated to pay to the government, reported as an expense in the income statement.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income, which can vary based on income level, jurisdiction, and other factors.

After-Tax Discount Rate

A discount rate that has been adjusted for the effect of taxes, utilized in evaluating the net present value (NPV) of an investment after taxes.

- Estimate income tax expenses based on cash flows and understand their effect on project net cash flows.

Verified Answer

To do this, we start with the annual cash inflows from the project, which are:

Year 1: $20,000

Year 2: $40,000

Year 3: $30,000

Year 4: $25,000

Year 5: $20,000

We then subtract the annual operating expenses and the annual depreciation expense:

Year 1: $10,000

Year 2: $12,000

Year 3: $14,000

Year 4: $16,000

Year 5: $18,000

Depreciation expense is calculated as follows:

Initial investment: $100,000

Residual value: $0

Useful life: 5 years

Depreciation expense = (Initial investment - Residual value) / Useful life

Depreciation expense = ($100,000 - $0) / 5

Depreciation expense = $20,000 per year

So, the taxable income in year 2 is:

Annual cash inflows - Annual operating expenses - Depreciation expense

$40,000 - $12,000 - $20,000 = $8,000

Next, we calculate the income tax expense using the company's tax rate of 30%:

Income tax expense = Taxable income * Tax rate

Income tax expense = $8,000 * 0.3 = $2,400

Finally, we need to account for the fact that the annual tax savings from depreciation will reduce the company's tax liability in year 2. The tax savings from depreciation in year 2 are calculated as:

Depreciation expense * Tax rate

$20,000 * 0.3 = $6,000

So, the income tax expense in year 2 is:

Income tax expense - Tax savings from depreciation

$2,400 - $6,000 = -$3,600

However, because the tax savings from depreciation is greater than the income tax expense, the company will actually receive a tax refund in year 2. This is because the tax savings from depreciation reduces the company's taxable income, which in turn reduces its tax liability.

To summarize:

Taxable income in year 2 = $8,000

Income tax expense in year 2 = $2,400

Tax savings from depreciation in year 2 = $6,000

Income tax expense in year 2 (after accounting for tax savings from depreciation) = $2,400 - $6,000 = -$3,600

Therefore, the answer is B) $18,000.

Learning Objectives

- Estimate income tax expenses based on cash flows and understand their effect on project net cash flows.

Related questions

A Company Anticipates Incremental Net Income (I ...

Last Year the Sales at Summit Corporation Were $419,000 and ...

Schweinsberg Corporation Is Considering a Capital Budgeting Project ...

Rhoads Corporation Is Considering a Capital Budgeting Project That Would ...

Fontana Corporation Is Considering a Capital Budgeting Project That Would ...