Asked by Alejandro Arias on Jun 01, 2024

Verified

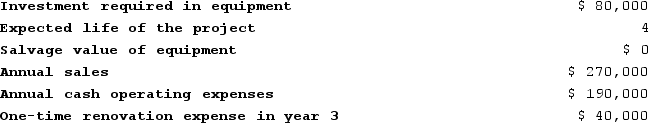

Mesko Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

A) $42,000

B) $56,000

C) $62,000

D) $80,000

After-Tax Discount Rate

The discount rate used in investment or project valuation that accounts for the effects of taxes on the project's cash flows.

Straight-Line Depreciation

A method of allocating an asset's cost evenly over its useful life.

Initial Investments

The initial amount of money invested in a project, asset, or company to start operations or purchase assets.

- Calculate and interpret the total cash flow net of income taxes for different years of a project’s life.

Verified Answer

Operating cash flow in year 2 = EBIT - taxes + depreciation

= $375,000 - ($375,000 * 0.30) + $230,000

= $332,500

Tax cash flow in year 2 = taxes paid in year 2 - tax savings from depreciation in year 2

= ($375,000 * 0.30) - ($230,000 * 0.30)

= $22,500

Total cash flow net of income taxes in year 2 = operating cash flow + tax cash flow

= $332,500 + $22,500

= $355,000

However, we need to adjust this amount for the salvage value in year 5, since that will also impact the cash flow in year 2. The salvage value is calculated as:

Salvage value in year 5 = $900,000 - ($900,000 * 0.30)

= $630,000

The book value of the equipment at the end of year 2 is equal to its initial cost minus two years of depreciation:

Book value at end of year 2 = $2,500,000 - ($2,500,000 / 5 * 2)

= $1,000,000

Since the book value is less than the salvage value, the equipment is sold in year 2 and the salvage value is included in the cash flow:

Total cash flow net of income taxes in year 2 = operating cash flow + tax cash flow + salvage value

= $332,500 + $22,500 + $630,000

= $985,000

The correct answer is (C) $62,000.

Learning Objectives

- Calculate and interpret the total cash flow net of income taxes for different years of a project’s life.

Related questions

Podratz Corporation Has Provided the Following Information Concerning a Capital ...

Mesko Corporation Has Provided the Following Information Concerning a Capital ...

Rhoads Corporation Is Considering a Capital Budgeting Project That Would ...

Schweinsberg Corporation Is Considering a Capital Budgeting Project ...

Last Year the Sales at Summit Corporation Were $419,000 and ...