Asked by Trenton Henderson on May 01, 2024

Verified

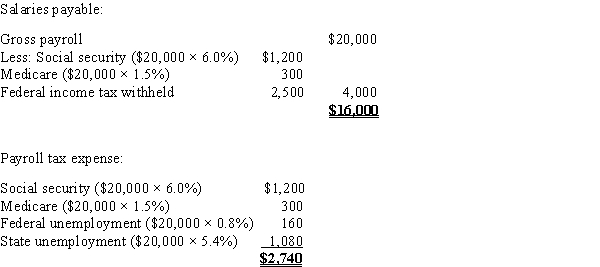

Perez Company has the following information for the pay period of January 15-31: Gross payroll $20,000 Federal income tax withhel d $2,500 Social security rate 6.0% Federal unemployment tax rate 0.8% Medicare rate 1.5% State unemployment tax rate 5.4%\begin{array}{lrlr}\text { Gross payroll } & \$ 20,000 & \text { Federal income tax withhel d } & \$ 2,500 \\\text { Social security rate } & 6.0 \% & \text { Federal unemployment tax rate } & 0.8 \% \\\text { Medicare rate } & 1.5 \% & \text { State unemployment tax rate } & 5.4 \%\end{array} Gross payroll Social security rate Medicare rate $20,0006.0%1.5% Federal income tax withhel d Federal unemployment tax rate State unemployment tax rate $2,5000.8%5.4% Assuming no employees are subject to ceilings for their earnings, calculate salaries payable and payroll tax expense.

Payroll Tax Expense

Taxes that are incurred by employers or employees based on salaries and wages, often covering Social Security and Medicare taxes.

Social Security Rate

The percentage of income that employees and employers are required to contribute to a country's social security programs.

Federal Unemployment Tax Rate

The percentage rate at which employers are taxed by the federal government to fund the unemployment compensation program for displaced workers.

- Develop the ability to journalize diverse financial transactions, including the calculation of accrued expenses and payroll.

- Understand methods to calculate and record employer's payroll taxes based on different scenarios.

Verified Answer

J&

Learning Objectives

- Develop the ability to journalize diverse financial transactions, including the calculation of accrued expenses and payroll.

- Understand methods to calculate and record employer's payroll taxes based on different scenarios.