Asked by Na'Diamond Swain on May 11, 2024

Verified

Below are two independent sets of transactions for Welcott Company:

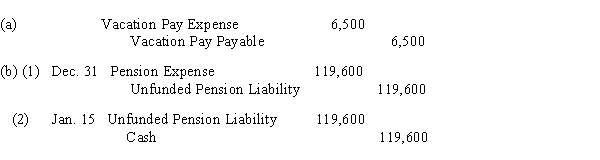

(a) Welcott provides its employees with varying amounts of vacation per year, depending on the length of employment. The estimated amount of the current year's vacation pay is $78,000. Journalize the adjusting entry required on January 31, the end of the first month of the year, to record the accrued vacation pay.

(b) Welcott maintains a defined contribution pension plan for its employees. The plan requires quarterly installments to be paid to the funding agent, Northern Trust, by the fifteenth of the month following the end of each quarter. Assuming that the pension cost is $119,600 for the quarter ended December 31, journalize entries to record

(1) the accrued pension liability on December 31 and

(2) the payment to the funding agent on January 15.

Defined Contribution Pension Plan

A retirement plan where an employer, employee, or both make contributions on a regular basis, but the final benefits received depend on the investment's performance.

Accrued Vacation Pay

The amount of money earned by employees for vacation time that has been accrued but not yet taken.

Funding Agent

A Funding Agent is an entity or individual responsible for managing and disbursing funds for a specific purpose, often related to financial operations, projects, or investments.

- Gain proficiency in recording different transactions, such as accrued expenses and payroll computations.

- Learn how to journalize adjusting entries for accrual-based expenses such as pension costs, employee benefits, and vacation pay.

Verified Answer

Learning Objectives

- Gain proficiency in recording different transactions, such as accrued expenses and payroll computations.

- Learn how to journalize adjusting entries for accrual-based expenses such as pension costs, employee benefits, and vacation pay.

Related questions

Perez Company Has the Following Information for the Pay Period ...

Kelly Howard Has the Following Transactions ...

Jordon James Started JJJ Consulting on January 1 ...

On December 31, a Business Estimates Depreciation on Equipment Used ...

On January 2, Safe Motorcycling Monthly Received a Check for ...