Asked by pamela saenz on May 31, 2024

Verified

An employee receives an hourly rate of $45, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $950; social security tax rate, 6.0%; Medicare tax rate, 1.5%; state unemployment compensation tax, 3.4% on the first $7,000; federal unemployment compensation tax, 0.8% on the first $7,000.Calculate the employer's payroll tax expense if:

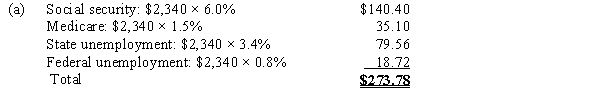

(a) This is the first payroll of the year and the employee has no cumulative earnings for the year to date.

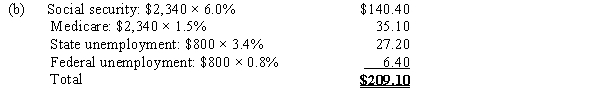

(b) The employee's cumulative earnings for the year prior to this week equal $6,200.

(c) The employee's cumulative earnings for the year prior to this week equal $118,700.

Social Security Tax Rate

The Social Security tax rate is a percentage of income that is taxed to fund the Social Security program, paid by both employees and employers.

Medicare Tax Rate

The percentage of an employee's earnings that is withheld by the employer to contribute to the U.S. Medicare program, which provides health insurance to eligible individuals.

Federal Unemployment Compensation Tax

A tax imposed on employers to fund the federal government's oversight of the state unemployment insurance programs.

- Acquire knowledge on the approaches to ascertain and log the payroll taxes for employers in diverse cases.

Verified Answer

KM

Learning Objectives

- Acquire knowledge on the approaches to ascertain and log the payroll taxes for employers in diverse cases.