Asked by Claudia Morris on May 10, 2024

Verified

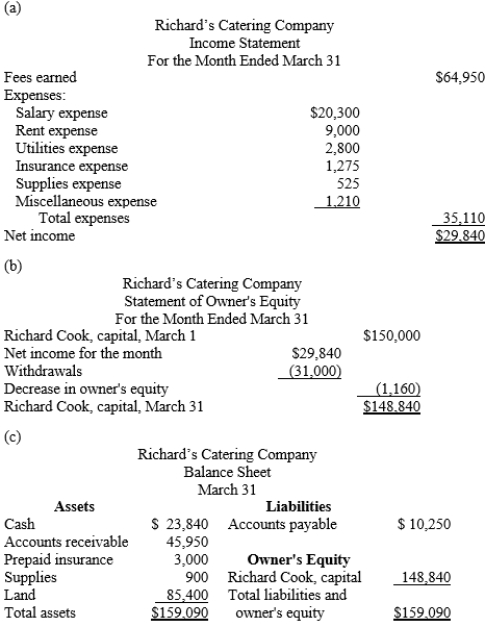

On March 1, the amount of Richard Cook's capital in Richard's Catering Company was $150,000. During March, he withdrew $31,000 from the business. The amounts of the various assets, liabilities, revenues, and expenses are as follows: Accounts payable $10,250 Accounts receivable 45,950 Cash 23,840 Fees earned 64,950 Insurance expense 1,275 Land 85,400 Miscellaneous expense 1,210 Prepaid insurance 3,000 Rent expense 9,000 Salary expense 20,300 Supplies 900 Supplies expense 525 Utilities expense 2,800\begin{array} { l r } \text { Accounts payable } & \$ 10,250 \\\text { Accounts receivable } & 45,950 \\\text { Cash } & 23,840 \\\text { Fees earned } & 64,950 \\\text { Insurance expense } & 1,275 \\\text { Land } & 85,400 \\\text { Miscellaneous expense } & 1,210 \\\text { Prepaid insurance } & 3,000 \\\text { Rent expense } & 9,000 \\\text { Salary expense } & 20,300 \\\text { Supplies } & 900 \\\text { Supplies expense } & 525 \\\text { Utilities expense } & 2,800\end{array} Accounts payable Accounts receivable Cash Fees earned Insurance expense Land Miscellaneous expense Prepaid insurance Rent expense Salary expense Supplies Supplies expense Utilities expense $10,25045,95023,84064,9501,27585,4001,2103,0009,00020,3009005252,800 Present, in good form,

(a) an income statement for March,

(b) a statement of owner's equity for March, and

(c) a balance sheet as of March 31.

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, culminating in net profit or loss.

Statement Of Owner's Equity

A financial document that shows the changes in the equity of a company over a specific period, reflecting investments, withdrawals, and the net income or loss.

Balance Sheet

A fiscal report summarizing the possessions, debts, and equity of shareholders in a company on a certain date.

- Acquire and provide an explanation on the aspects and aims of primary financial statements, comprising the income statement, owner's equity statement, balance sheet, and cash flow statement.

- Formulate an income statement and compute the net earnings or net shortfall for a particular period.

- Develop an equity statement to illustrate the adjustments in the owner's equity over time.

Verified Answer

Learning Objectives

- Acquire and provide an explanation on the aspects and aims of primary financial statements, comprising the income statement, owner's equity statement, balance sheet, and cash flow statement.

- Formulate an income statement and compute the net earnings or net shortfall for a particular period.

- Develop an equity statement to illustrate the adjustments in the owner's equity over time.

Related questions

The Total Assets and Total Liabilities of Paul's Pools, a ...

For Each of the Following, Determine the Amount of Net ...

A Summary of Cash Flows for Evelyn's Event Planning for ...

Using the Following Accounting Equation Elements and Their Balances, Prepare ...

Eric Wood, CPA, Was Organized on January 1 as a ...