Asked by Quentin Pharis on May 17, 2024

Verified

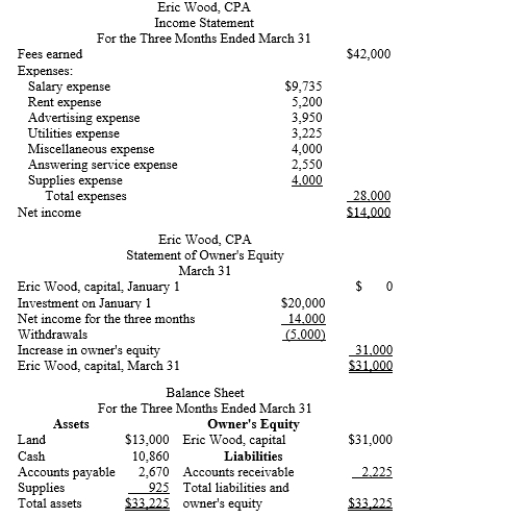

Eric Wood, CPA, was organized on January 1 as a proprietorship. List the errors that you find in the following financial statements and prepare the corrected statements for the three months ended March 31.+  ?

?

CPA

Certified Public Accountant, a designation given to someone who has passed the Uniform CPA Examination and met additional state education and experience requirements in accounting.

Proprietorship

A form of business organization owned by a single individual who is responsible for all its debts and entitled to all its profits.

Financial Statements

Documents that provide an overview of a company's financial condition, including the balance sheet, income statement, and cash flow statement.

- Gain knowledge of and articulate the components and functions of essential financial statements like the income statement, equity statement, balance sheet, and cash flow statement.

- Detect inaccuracies in financial reports and execute necessary corrections.

Verified Answer

(1)Miscellaneous expense is incorrectly listed after utilities expense on the income statement. Miscellaneous expense should be listed as the last expense, regardless of the amount.

(2)The operating expenses are incorrectly added. Instead of $28,000, the total should be $32,660.

(3)Because operating expenses are incorrectly added, the net income is incorrect. It should be listed as $9,340.

(4)The statement of owner's equity should be for a period of time instead of a specific date. That is, the statement of owner's equity should be reported "For the Three Months Ended March 31."

(5)Because the net income was incorrect, the increase in owners' equity and the balance in Eric Wood, Capital are incorrect. They should both be shown as $24,340.

(6)The name of the company is missing from the balance sheet heading.

(7)The balance sheet should be as of "March 31," not "For the Three Months Ended March 31."

(8)Cash, not land, should be the first asset listed on the balance sheet.

(9)Accounts payable is incorrectly listed as an asset on the balance sheet. Accounts payable should be listed as a liability.

(10)Liabilities should be listed on the balance sheet ahead of owner's equity.

(11)Accounts receivable is incorrectly listed as a liability on the balance sheet. Accounts receivable should be listed as an asset.

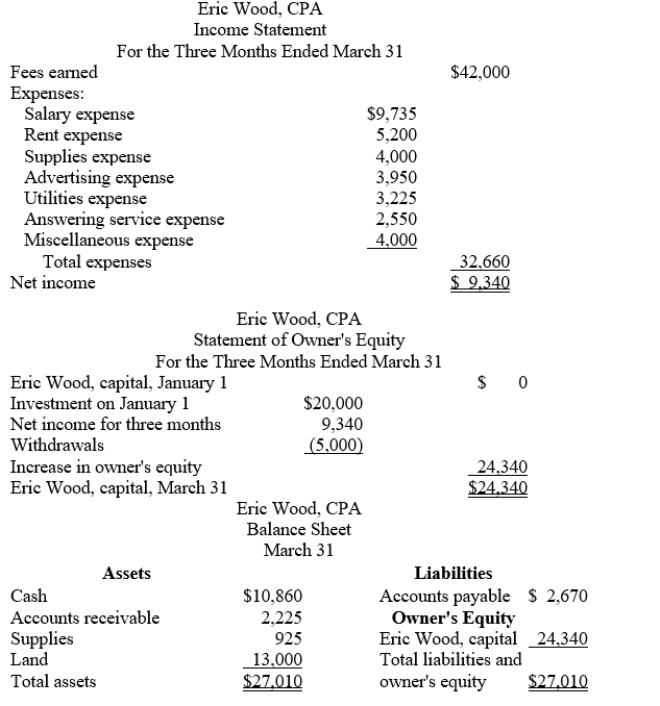

(12)The assets do not total to $33,225 as shown, making the balance sheet out of balance.Correctly prepared financial statements for Eric Wood, CPA, are shown below.??

Learning Objectives

- Gain knowledge of and articulate the components and functions of essential financial statements like the income statement, equity statement, balance sheet, and cash flow statement.

- Detect inaccuracies in financial reports and execute necessary corrections.

Related questions

Using the Following Accounting Equation Elements and Their Balances, Prepare ...

Using the Following Accounting Equation Elements and Their Balances, Prepare ...

What Information Does the Income Statement Give to Business Users

Prepare a Statement of Owner's Equity for Thompson Computer Services ...

Harris Designers Began Operations on April 1 ...