Asked by Marissa Gonçalves on May 08, 2024

Verified

The total assets and total liabilities of Paul's Pools, a proprietorship, at the beginning and at the end of the current fiscal year are as follows:

January 1 December 31 Total assets $280,000$475,000 Total liabilities 205,000130,000\begin{array}{lrr}&\text { January } 1 & \text { December } 31\\\text { Total assets } & \$ 280,000 & \$ 475,000 \\\text { Total liabilities } & 205,000 & 130,000\end{array} Total assets Total liabilities January 1$280,000205,000 December 31$475,000130,000

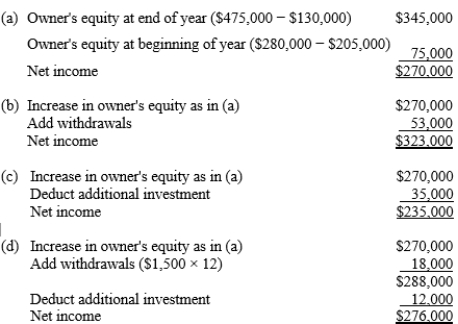

(a)Determine the amount of net income earned during the year. The owner did not invest any additional assets in the business during the year and made no withdrawals.

(b)Determine the amount of net income during the year. The assets and liabilities at the beginning and end of the year are unchanged from the amounts presented above. However, the owner withdrew $53,000 in cash during the year

(no additional investments).

(c)Determine the amount of net income earned during the year. The assets and liabilities at the beginning and end of the year are unchanged from the amounts presented above. However, the owner invested an additional $35,000 in cash in the business in June of the current fiscal year

(no withdrawals).

(d)Determine the amount of net income earned during the year. The assets and liabilities at the beginning and end of the year are unchanged from the amounts presented above. However, the owner invested an additional $12,000 in cash in August of the current fiscal year and made 12 monthly cash withdrawals of $1,500 each during the year.

Net Income

A company's overall earnings following the deduction of all costs and taxes from its gross income.

Fiscal Year

A twelve-month period used for accounting purposes and preparation of financial statements, which may not align with the calendar year.

Withdrawals

The act of taking out cash or other assets from a business by the owner for personal use.

- Investigate and interpret financial accounts to measure a firm's financial health.

- Generate an income statement and estimate the net gain or net loss for a defined period.

Verified Answer

BL

Learning Objectives

- Investigate and interpret financial accounts to measure a firm's financial health.

- Generate an income statement and estimate the net gain or net loss for a defined period.