Asked by Samantha Shaughnessy on Jun 27, 2024

Verified

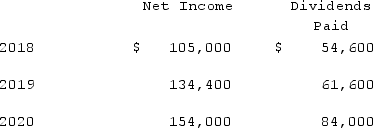

On January 1, 2018, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.Carper earned income and paid cash dividends as follows:  On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

Equity Method

This accounting approach is applied when an investor holds significant control over an investee, indicating a substantial interest but not full control or majority stake.

Consolidation Entries

Accounting entries used in preparing consolidated financial statements that eliminate transactions between the parent company and its subsidiaries.

Control Premium

An additional amount that a buyer is willing to pay over the current market value of a company to obtain controlling interest.

- Determine the impact of fair value adjustments on the carrying amount of acquired assets and goodwill.

- Construct an allocation and amortization timetable based on fair value, which includes goodwill.

Verified Answer

SG

Sarah GegenJun 29, 2024

Final Answer :

From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. ![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_141a_948d_41896429bcf6_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2b_948d_2df0a84705c0_TB7395_00.jpg) Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ]

Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] ![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2c_948d_3feb78cb8aab_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2d_948d_f5571a352e64_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_623e_948d_fb07108b9ccd_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_623f_948d_63d897402fe1_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_8950_948d_17242c3a4a0c_TB7395_00.jpg) Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880

Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_141a_948d_41896429bcf6_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2b_948d_2df0a84705c0_TB7395_00.jpg) Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ]

Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] ![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2c_948d_3feb78cb8aab_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2d_948d_f5571a352e64_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_623e_948d_fb07108b9ccd_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_623f_948d_63d897402fe1_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_8950_948d_17242c3a4a0c_TB7395_00.jpg) Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880

Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880

Learning Objectives

- Determine the impact of fair value adjustments on the carrying amount of acquired assets and goodwill.

- Construct an allocation and amortization timetable based on fair value, which includes goodwill.