Asked by JAVARIN OTHONG on Jun 28, 2024

Verified

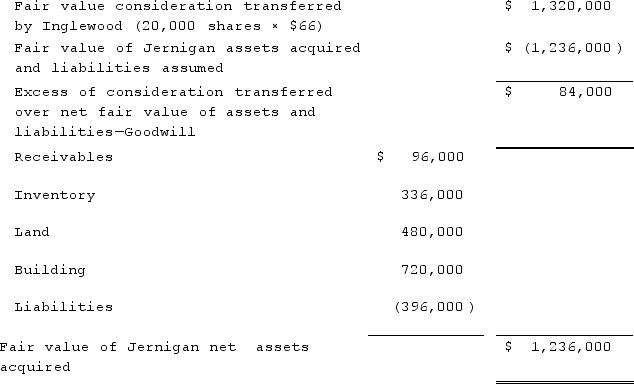

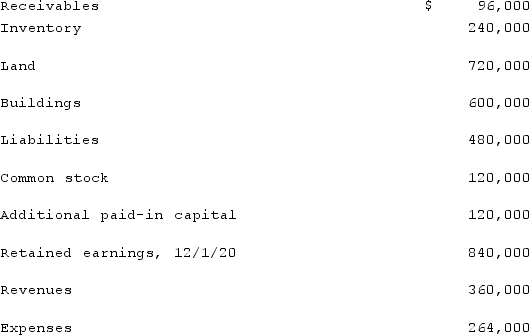

Jernigan Corp. had the following account balances at 12/1/20:  Several of Jernigan's accounts have fair values that differ from book value. The fair values are: Land - $480,000; Building - $720,000; Inventory - $336,000; and Liabilities - $396,000. Inglewood Inc. acquired all of the outstanding common shares of Jernigan by issuing 20,000 shares of common stock having a $6 par value per share, but a $66 fair value per share. Stock issuance costs amounted to $12,000.Required:Prepare a fair value allocation and goodwill schedule at the date of the acquisition.

Several of Jernigan's accounts have fair values that differ from book value. The fair values are: Land - $480,000; Building - $720,000; Inventory - $336,000; and Liabilities - $396,000. Inglewood Inc. acquired all of the outstanding common shares of Jernigan by issuing 20,000 shares of common stock having a $6 par value per share, but a $66 fair value per share. Stock issuance costs amounted to $12,000.Required:Prepare a fair value allocation and goodwill schedule at the date of the acquisition.

Fair Value Allocation

The process of assigning a fair market value to all assets and liabilities of a company, often conducted during the acquisition process.

Par Value

Par value is the nominal or face value of a bond, stock, or other financial instrument, as stated by the issuer.

Common Stock

Shares of ownership in a corporation that entitle the shareholder to a share of the company’s profits and a right to vote on company matters.

- Create a fair value allocation and goodwill schedule as part of the business combination process.

Verified Answer

MR

Learning Objectives

- Create a fair value allocation and goodwill schedule as part of the business combination process.