Asked by Vanessa Massie on Jul 04, 2024

Verified

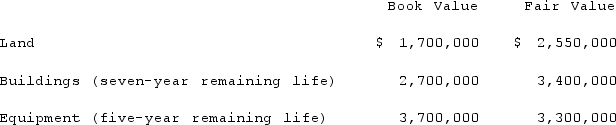

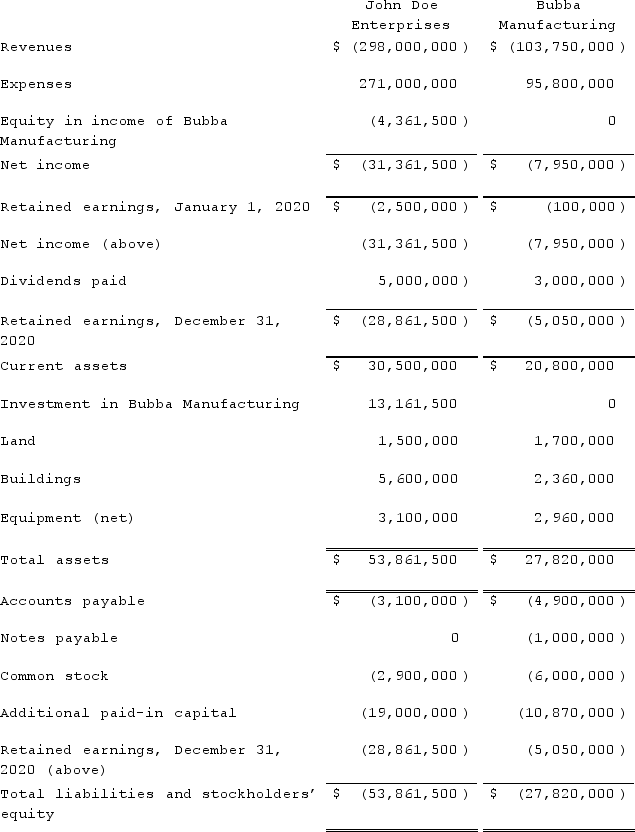

On January 1, 2020, John Doe Enterprises (JDE) acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2020.  For internal reporting purposes, JDE employed the equity method to account for this investment.The following account balances are for the year ending December 31, 2020 for both companies.

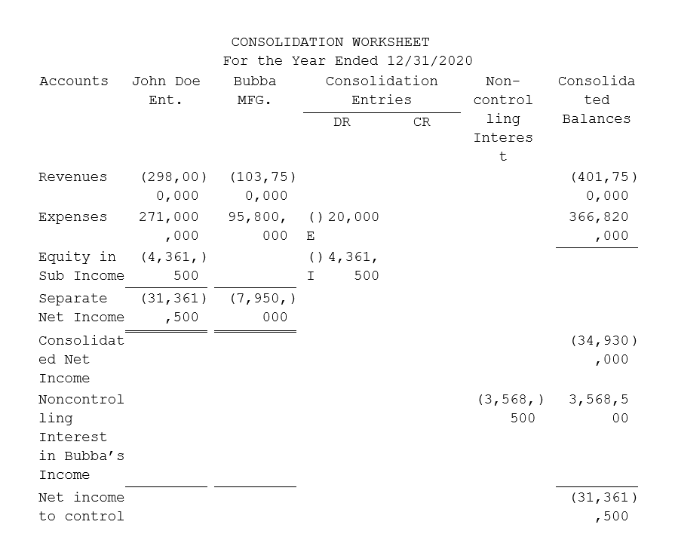

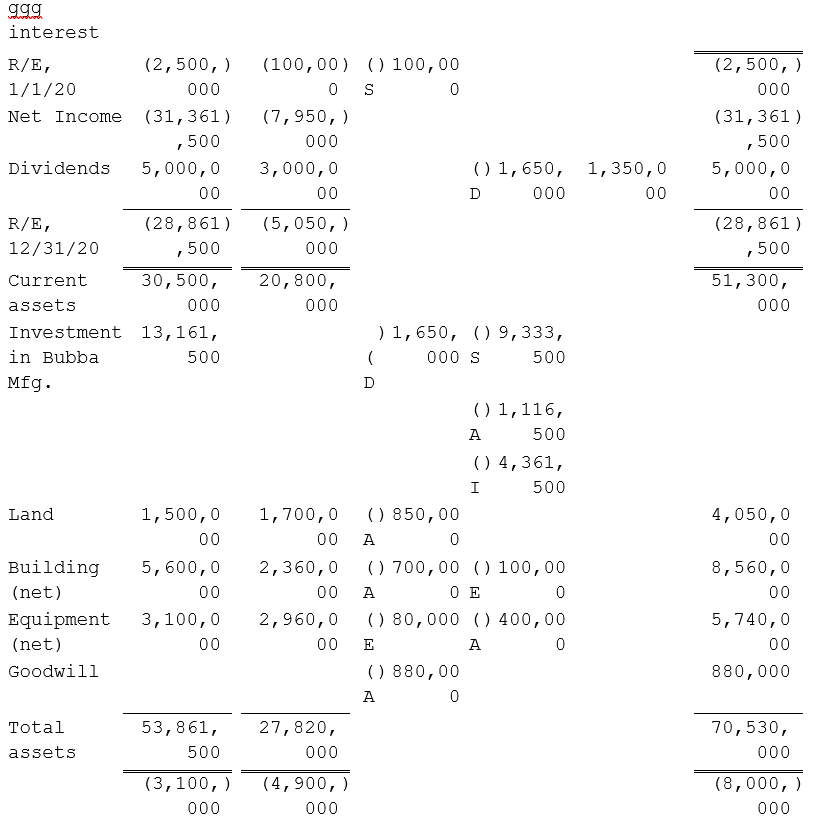

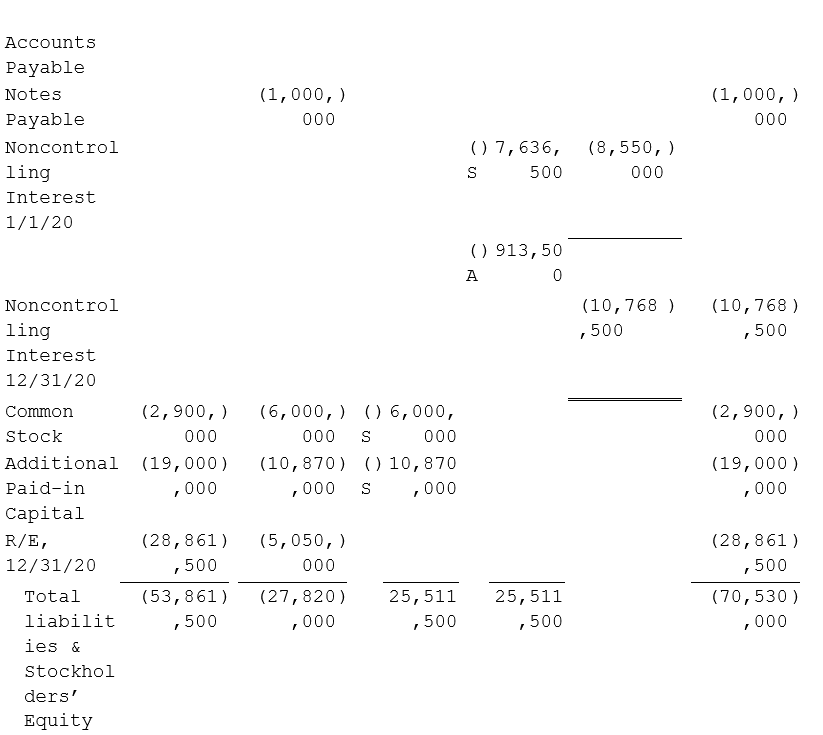

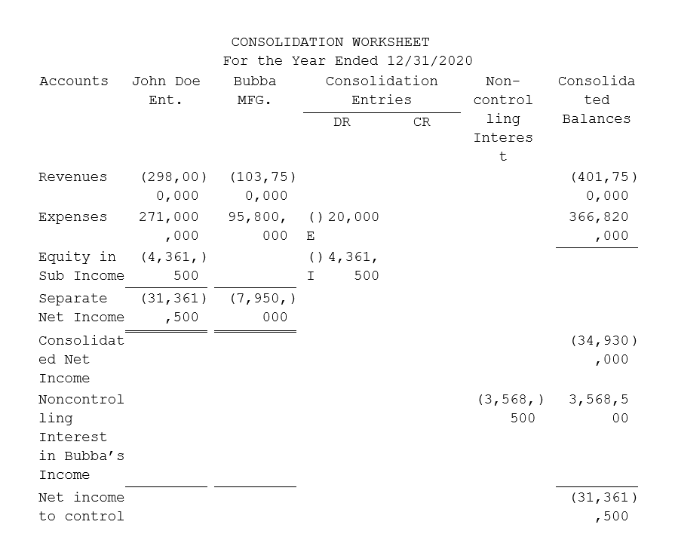

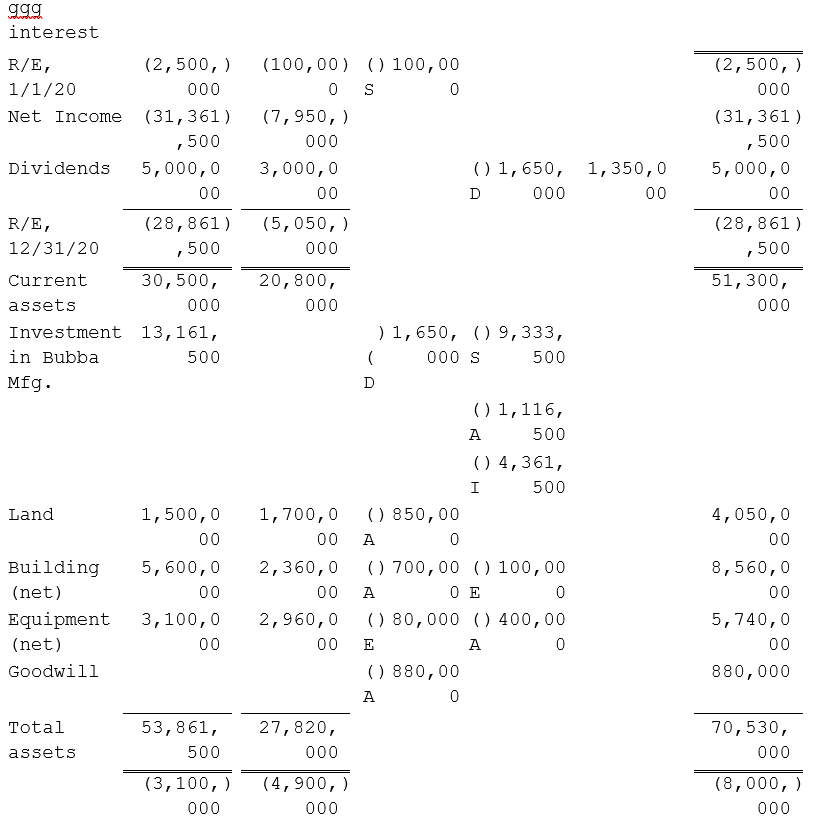

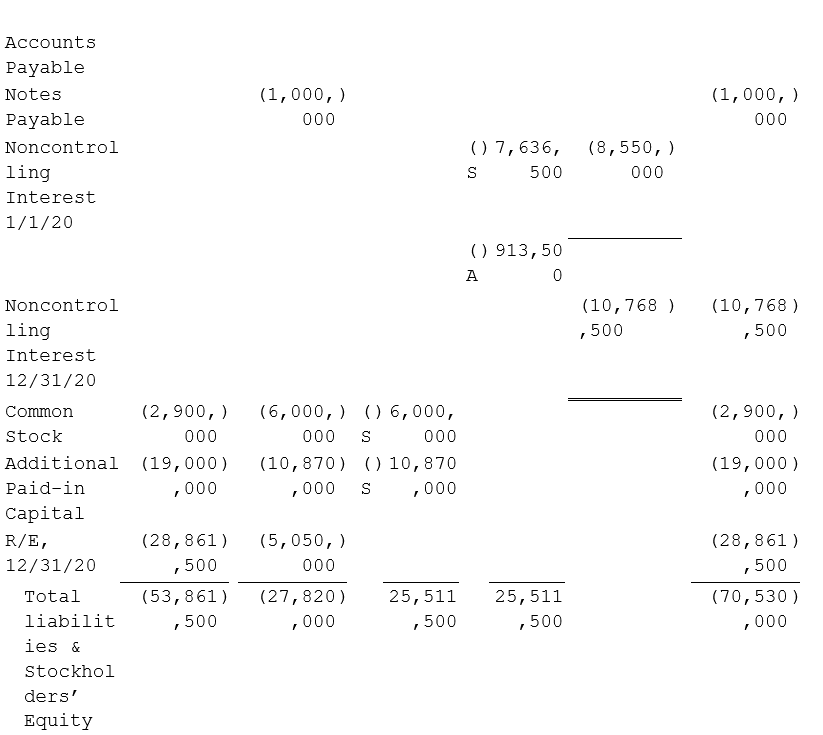

For internal reporting purposes, JDE employed the equity method to account for this investment.The following account balances are for the year ending December 31, 2020 for both companies.  Required:Prepare a consolidation worksheet for this business combination. Assume goodwill has been reviewed and there is no goodwill impairment.

Required:Prepare a consolidation worksheet for this business combination. Assume goodwill has been reviewed and there is no goodwill impairment.

Consolidation Worksheet

An instrument utilized for creating combined financial reports that merges the finances of a parent entity with those of its subsidiary companies.

Goodwill Impairment

An accounting process involving the reassessment of the value of goodwill on the balance sheet and reducing it if its market value has declined below the carrying value.

- Employ the acquisition strategy to evaluate the amount of goodwill in corporate mergers.

- Develop a schedule for fair-value allocation and amortization, incorporating goodwill.

Verified Answer

IT

Ibrahim TounkaraJul 07, 2024

Final Answer :

Consolidation Worksheet for John Doe Enterprises and Bubba Manufacturing at 12/31/20.

Learning Objectives

- Employ the acquisition strategy to evaluate the amount of goodwill in corporate mergers.

- Develop a schedule for fair-value allocation and amortization, incorporating goodwill.