Asked by Jesica Alarcon on Jul 24, 2024

Verified

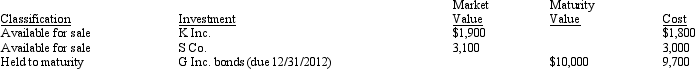

On January 1, 2010, A Corp.had the following investments:

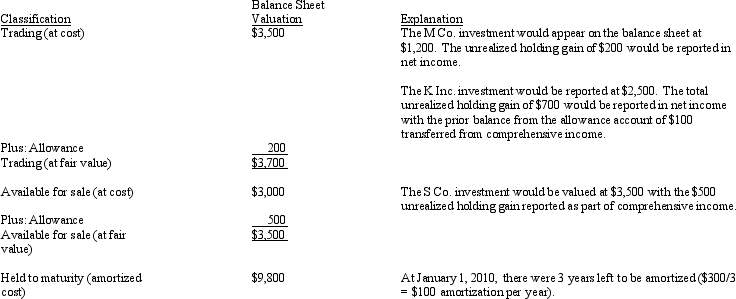

During the year, A Corp.acquired for trading M Co.stock for $1, 000.At year-end, the stock has a fair market value of $1, 200.The K Inc.investment was transferred from AFS to trading on December 31 when the fair market value was $2, 500.The S Co.investment had a December 31 market value of $3, 500.The G Inc.bonds had a fair market value on December 31 of $9, 850.

During the year, A Corp.acquired for trading M Co.stock for $1, 000.At year-end, the stock has a fair market value of $1, 200.The K Inc.investment was transferred from AFS to trading on December 31 when the fair market value was $2, 500.The S Co.investment had a December 31 market value of $3, 500.The G Inc.bonds had a fair market value on December 31 of $9, 850.

Required:

What disclosures are required in the December 31, 2010 financial statements for investments?

Fair Market Value

The estimated price at which an asset would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell.

Investments

Assets purchased with the aim of generating income or appreciating in value over time, such as stocks, bonds, or real estate.

Disclosures

These are notes in financial statements that provide additional insight into the presented figures, accounting policies, and other relevant information.

- Account for the changes in fair value of investments and their impacts on financial statements.

Verified Answer

Learning Objectives

- Account for the changes in fair value of investments and their impacts on financial statements.

Related questions

On December 31, 2010, the England Company Held 8%, $200 ...

Which of the Following Correctly Presents the Entries Made by ...

On January 1, the Valuation Allowance for Available-For-Sale Investments Account ...

During the First Year of Operations, Makala Company Purchased Two ...

Following Are Data for the Trading Securities Held by Lindy ...