Asked by Victoria Rojas on Jul 15, 2024

Verified

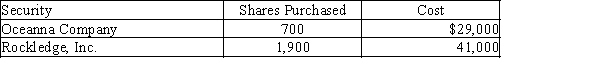

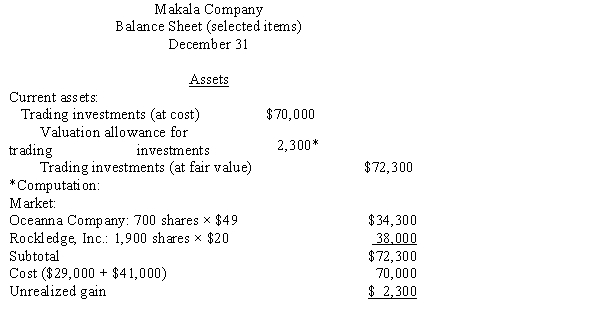

During the first year of operations, Makala Company purchased two trading investments as follows:  Assume that as of December 31, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share. Makala had 10,000 shares of no-par stock outstanding that was issued for $150,000. For the year ending December 31, Makala had net income of $105,000. No dividends were paid.

Assume that as of December 31, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share. Makala had 10,000 shares of no-par stock outstanding that was issued for $150,000. For the year ending December 31, Makala had net income of $105,000. No dividends were paid.

(a)Prepare the current assets section of the balance sheet presentation for the trading securities as of December 31.(b)Explain how the gain or loss would be reported on the income statement.

Trading Investments

Securities bought and held primarily for selling them in the near term to generate income on short-term price differences.

Market Value

The current price at which an asset or service can be bought or sold in a market, reflecting its perceived value by participants.

Balance Sheet

A financial report that presents the assets, liabilities, and shareholders' equity of a company at a specific time.

- Learn the procedures for treatment and reporting of trading securities on financial statements.

- Master the approach for recording investment value adjustments to fair value and their repercussions on financial statements.

Verified Answer

(b) The gain would be reported as "Other revenue" on the income statement.

(b) The gain would be reported as "Other revenue" on the income statement.

Learning Objectives

- Learn the procedures for treatment and reporting of trading securities on financial statements.

- Master the approach for recording investment value adjustments to fair value and their repercussions on financial statements.

Related questions

Following Are Data for the Trading Securities Held by Lindy ...

On January 1, the Valuation Allowance for Available-For-Sale Investments Account ...

The Account Unrealized Gain on Trading Investments Should Be Included ...

The Account Unrealized Loss on Trading Investments Should Be Included ...

Financial Statements Include Assets Listed at ...