Asked by Gabrielle Richard on Jul 14, 2024

Verified

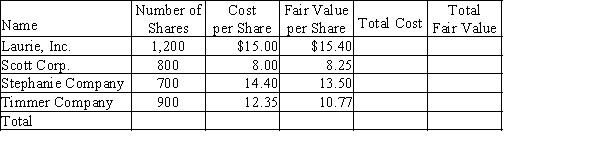

Following are data for the trading securities held by Lindy Company as of December 31:  (a) Complete the table above to find the total cost and fair value for the company's trading securities portfolio.(b) Calculate and record the required December 31 adjustment.(c) Explain how the adjustment from step (b) is reported on Lindy's financial statements.

(a) Complete the table above to find the total cost and fair value for the company's trading securities portfolio.(b) Calculate and record the required December 31 adjustment.(c) Explain how the adjustment from step (b) is reported on Lindy's financial statements.

Trading Securities

Financial instruments that are purchased by a company not for long-term investment but rather for the purpose of earning a return through short-term price fluctuations.

Fair Value

An estimate of the price at which an asset or liability would be traded in a fair transaction between willing parties.

Financial Statements

Descriptions giving insight into a business's financial situation, covering the balance sheet, income statement, and cash flow statement.

- Comprehend the treatment and reporting of trading securities on financial statements.

- Know how to record adjustments for investments to fair value and their impact on financial statements.

Verified Answer

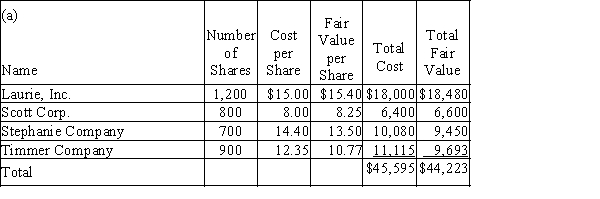

(b)Unrealized Loss on Trading Investments

(b)Unrealized Loss on Trading Investments1,372

Valuation Allowance for Trading Investments

1,372

$45,595 - $44,223 = $1,372 unrealized loss

(c) The unrealized loss will be shown as an "Other Expense" on the income statement and the valuation allowance will be shown as a reduction of the value of the trading investment portfolio (at cost) in the assets section of the balance sheet.

Learning Objectives

- Comprehend the treatment and reporting of trading securities on financial statements.

- Know how to record adjustments for investments to fair value and their impact on financial statements.

Related questions

During the First Year of Operations, Makala Company Purchased Two ...

On January 1, the Valuation Allowance for Available-For-Sale Investments Account ...

Financial Statements Include Assets Listed at ...

The Account Unrealized Loss on Trading Investments Should Be Included ...

The Account Unrealized Gain on Trading Investments Should Be Included ...