Asked by Michael Megler on Jun 21, 2024

Verified

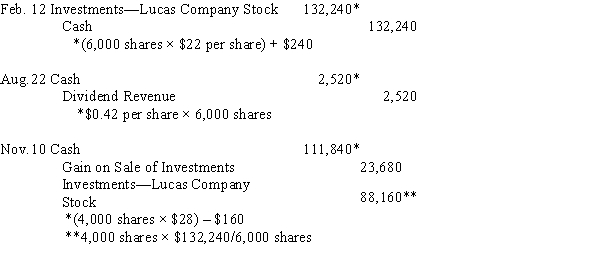

On February 12, Addison, Inc. purchased 6,000 shares of Lucas Company at $22 per share plus a $240 brokerage fee. This purchase represents less than 20% ownership of the Lucas Company. On August 22, Lucas paid a $0.42 dividend per share. On November 10, 4,000 shares of Lucas stock were sold for $28 per share less a $160 brokerage fee.

Prepare the journal entries for the original purchase, dividend, and sale under the fair value method.

Fair Value Method

An accounting approach where assets and liabilities are valued at their current market price to determine their worth.

Brokerage Fee

A fee charged by a broker for executing transactions or providing specialized services.

Dividend Per Share

The total amount of dividends declared by a corporation for each outstanding share of common stock, reflecting the earnings distributed to shareholders.

- Distinguish between the fair value and equity accounting methods for recording investments.

Verified Answer

Learning Objectives

- Distinguish between the fair value and equity accounting methods for recording investments.

Related questions

Wendell Company Owns 28% of the Common Stock of Porter ...

On January 1 Jarret Corporation Purchased a 35% Equity in ...

On January 5 2017 Grouse Company Purchased the Following Stock \(\$ ...

On January 1 2017 Mink Company Purchased 5000 Shares of ...

Under the Cost Method Dividends Received from an Investee Company ...