Asked by Sophia Chiang on May 05, 2024

Verified

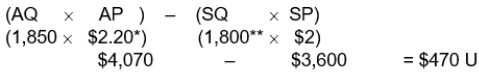

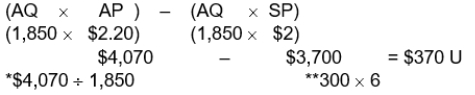

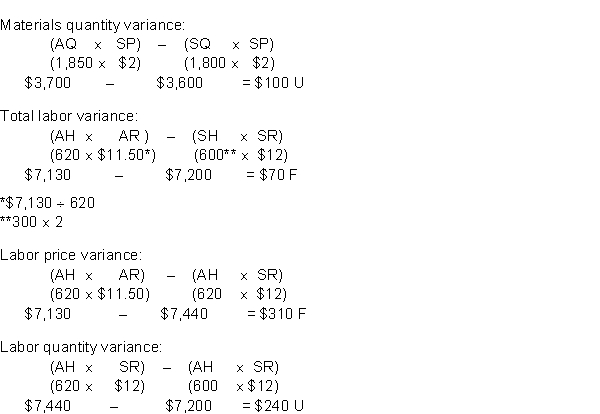

Purvis Manufacturing which produces a single product has prepared the following standard cost sheet for one unit of the product. Direct materials (6 pounds at $2 per pound) $12 Direct labor (2 hours at $12 per hour) $24\begin{array}{ll}\text { Direct materials (6 pounds at } \$ 2 \text { per pound) } & \$ 12 \\\text { Direct labor }(2 \text { hours at } \$ 12 \text { per hour) } & \$ 24\end{array} Direct materials (6 pounds at $2 per pound) Direct labor (2 hours at $12 per hour) $12$24 During the month of April the company manufactures 300 units and incurs the following actual costs. Direct materials purchased and used (1,850 pounds) $4,070Direct labor (620 hours) $7,130\begin{array}{llr} \text { Direct materials purchased and used (1,850 pounds) } &\$4,070\\ \text {Direct labor (620 hours) } &\$7,130\\\end{array} Direct materials purchased and used (1,850 pounds) Direct labor (620 hours) $4,070$7,130

Instructions

Compute the total price and quantity variances for materials and labor.

Total Price Variance

The difference between the actual cost of a good or service and its expected cost based on standard pricing.

Quantity Variances

Differences between actual and expected (or standard) quantities of inputs or outputs in the production process, affecting costs.

Standard Cost Sheet

A document that outlines the expected costs associated with the production of a product, including materials, labor, and overhead.

- Learn the steps and decision-making process in computing material price variances.

- Perform evaluations and analyses on variances within direct labor, emphasizing labor rate and efficiency differences.

Verified Answer

Learning Objectives

- Learn the steps and decision-making process in computing material price variances.

- Perform evaluations and analyses on variances within direct labor, emphasizing labor rate and efficiency differences.

Related questions

The Difference Between Actual Hours Times the Actual Pay Rate ...

The Difference Between Actual Quantity of Materials Times the Standard ...

If the Actual Direct Labor Hours Worked Is Greater Than ...

Obenshain Corporation Manufactures One Product ...

The Raw Materials Price Variance for the Month Is Closest ...