Asked by Tishera Brooks on Jul 28, 2024

Verified

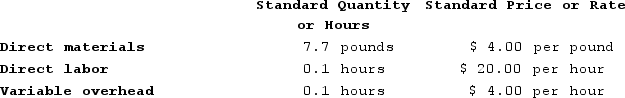

Milar Corporation makes a product with the following standard costs:  In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The labor rate variance for January is:

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The labor rate variance for January is:

A) $260 Unfavorable

B) $273 Unfavorable

C) $260 Favorable

D) $273 Favorable

Direct Materials

Ingredients that are specifically identifiable in the creation of a certain product.

Direct Labor-Hours

The broad sum of hours dedicated by workers directly in the manufacturing workflow.

Variable Overhead

Indirect production costs that vary with the level of output, such as utilities for a manufacturing plant.

- Execute computations and investigate variances associated with direct labor's rate and efficiency aspects.

Verified Answer

Actual Labor Rate = Actual Labor Cost / Actual Hours

Actual Labor Rate = $4,473 / 210 hours

Actual Labor Rate = $21.30 per hour

Next, we need to calculate the standard labor rate per hour:

Standard Labor Rate = Standard Labor Cost / Standard Hours

Standard Labor Rate = $8.00 / 0.50 hours

Standard Labor Rate = $16.00 per hour

Finally, we can calculate the labor rate variance:

Labor Rate Variance = (Actual Hours x (Actual Labor Rate - Standard Labor Rate))

Labor Rate Variance = 210 hours x ($21.30 - $16.00)

Labor Rate Variance = 210 hours x $5.30

Labor Rate Variance = $1,113

Since the labor rate variance is unfavorable (the actual rate is higher than the standard rate), the answer is B) $273 Unfavorable.

Learning Objectives

- Execute computations and investigate variances associated with direct labor's rate and efficiency aspects.

Related questions

Fluegge Incorporated Has Provided the Following Data Concerning One of ...

Hofbauer Incorporated Has Provided the Following Data Concerning One of ...

Chhom Corporation Makes a Product Whose Direct Labor Standards Are ...

The Following Labor Standards Have Been Established for a Particular ...

Wolery Incorporated Has Provided the Following Data Concerning One of ...